It will likely take new lows in QQQ for new highs in VXN- and for a new buy signal to emerge.

shutterstock.com – StockNews

There is a commonality between a three-year old on a family car trip and traders and investors. Both groups want to know “Are We There Yet”. While neither three -year olds or traders tend to have much patience, at least the ultimate arrival time is known in advance on a family car trip. The ultimate low is only known after the fact in the stock market.

In my article from several weeks ago, I talked about how option prices can help predict future stock prices, in this case a short-term top. It was a take on the Warren Buffett philosophy of being fearful when others are greedy. Option prices are the embodiment of this notion. When stocks rise, option prices tend to fall and vice-versa.

This is evidenced in the VIX which tends to correlate inversely with the S&P 500. The VXN is a similar measure for the NASDAQ 100 stocks. Both the VIX and VXN are a 30-day measure of option prices.

I opined back then about how the recent lows in VXN foreshadowed a short-term top and an impending pullback for the NASDAQ 100, or QQQ. That proved to be the case with the QQQ dropping 10% over the past few weeks. Now the question is how low prices will go until QQQ find some support.

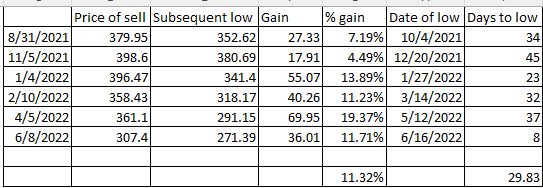

Once again, I will turn to using option prices to give me a clue as to when the market malaise may be getting overdone. Just as the lows in VXN usually point to a pullback, the spike to highs is usually a reliable indication that a short-term bottom may be in the offing. The chart below shows the previous six times over the past year when VXN spiked to highs and then began to head lower

Each instance marked a significant short-term top in the VXN and a meaningful short-term bottom in QQQ. VXN has flattened out recently. It may take meaningful new lows in QQQ to get VXN top explode higher towards the 40 area and a new buy signal.

The last four spikes in the VXN all topped out near the 40 area. That would certainly be a level to consider turning from bearish to bullish on the QQQ. A re-test of the major support level at $290 in the QQQ would be just over a 10% pullback from the recent highs near $325. It would also equate to just about the average drop of 11.32% for the last six sell signals. It is highly unlikely that a drop to $290 would take VXN higher as well. Likely need new lows.

All said, QQQ still has a little further to go until it finds some footing if history holds. Important to remember that using an implied volatility-based VXN methodology is more of a market timing tool for traders. The ultimate low in QQQ will depend more on traditional metrics like valuations.

Back to the original question of “Are We There Yet”. The answer is no, not yet. If the past is any guide, though, option-prices are saying it looks like we are definitely getting much closer.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

QQQ shares closed at $289.32 on Friday, down $-1.78 (-0.61%). Year-to-date, QQQ has declined -27.05%, versus a -18.22% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post QQQ Is Not There Quite Yet appeared first on StockNews.com