There are few real estate markets with as many attractive cities as California. From the allure of luxury and lifestyle in Los Angeles to the technology heart of San Francisco, there’s a reason why California rents are often reported to be the highest in the nation.

The California real estate market is an important one for real estate investors thanks to its large and diverse economy that spans numerous industries, including technology, entertainment, and agriculture. This creates sky-high demand for housing, leading to attractive rental income and consistent property appreciation. It also makes California an incredibly competitive real estate market.

It’s not the easiest region to achieve positive cash flow in real estate, with a higher entry point than many other states. Those who already own property, have recently inherited a home, or have decent capital to reduce debt servicing tend to fare the best in the Californian market.

Whether you’re a seasoned investor or new to the market, BiggerPockets has teamed up with Belong to bring you a snapshot of key regions that give you an indication of the market’s state and help you make decisions for the year ahead. Belong is a modern alternative to property management companies that humanizes the rental experience and makes it easier for individual homeowners to manage real estate investments.

Rental Rates in California

According to the 2021 Census data, California’s median gross rent paid per month is $1,698, with 49% of households renter-occupied. Of course, when looking at median and statewide figures, it’s worth remembering that these incorporate everything from a studio apartment in Brentwood to a luxurious mansion in Beverly Hills. Market rates fluctuate all the time, and California is a big state, too, with a number of unique and diverse localities within it.

Here’s a quick snapshot of the Californian market based on the latest U.S. Census data.

Population: 39.24 million

Median annual household income: $84,907

Median monthly gross rent: $1,698

Median monthly household costs: $1,810

Median annual real estate taxes: $5,151

Renter-occupied: 49.1%

Does this paint a realistic picture of what to expect in the Californian real estate market? Not necessarily. Although the median monthly household cost is $1,810, the reality is that 42.6% of households have costs over $2,000 per month, with almost 20% facing costs of over $3,000 per month.

Let’s take a look at some of the major metropolitan areas within California, along with their census data and trending data from Belong and their data partners on what people are actually paying in these areas.

Los Angeles

Los Angeles County is home to over 9.8 million people, with over 3.8 million living in the L.A. metro area. The median household income is slightly lower than California as a whole at $76,367, with a median gross rent of $1,653.

What’s the average rental rate in 2023?

Los Angeles is a high-demand city, with 63% of households renter-occupied. According to real estate listing sites and Belong’s data partners, the average rent in Los Angeles as of January 2023 is:

Studio: $1,698 (+10% YoY)

1-Bedroom: $2,395 (+7% YoY)

2-Bedroom: $3,190 (+7% YoY)

3-Bedroom: $4,378 (+4% YoY)

4-Bedroom: $5,925 (no change)

Belong, who caters primarily to owners of single-family homes and condos, has seen an average rental rate of $3,885.92/month for the Los Angeles market. Cities in the L.A. market attract the highest rates on the Belong platform, sitting 3% above San Francisco’s Bay Area and 53% higher than the average rent in Miami, Florida.

While rents have continued to rise across California, it hasn’t been all “flowers and sunshine” for homeowners and real estate investors in Los Angeles. Between 2020 – 2022, many individual investors have been hit with rent freezes and eviction moratoriums. In some regions, rents even dropped as people left key metro areas in favor of more affordable housing and larger spaces.

As the pandemic effect slows and people return to cities, the rental market is seeing a return to more regular seasonal changes. So despite reports of rental growth dropping for single-family homes, L.A. rents are still up year-on-year, and dips could be more closely related to slower demand during the winter months.

San Francisco

In San Francisco’s Bay Area, with a fruitful job market and smaller population than Los Angeles, the average income is considerably higher at $126,187. The asking rents match, with the average studio apartment renting above $2,000 and single-family homes with two or more bedrooms averaging $4,000/month or higher.

Population: 815,201

Median annual household income: $126,187

Median monthly gross rent: $2,130

What’s the average rental rate in San Francisco in 2023?

According to Belong’s data partner, the average rent in San Francisco as of January 2023 is:

Studio: $2,195 (+6% YoY)

1-Bedroom: $2,950 (+4% YoY)

2-Bedroom: $3,950 (no change)

3-Bedroom: $4,895 (+5% YoY)

4-Bedroom: $6,000 (+6% YoY)

Like Los Angeles, the Bay Area has a high demand for rentals, with 62% of households renter-occupied, thanks to the lucrative technology industry and the job market. Like most technology hubs, the Bay Area saw a decline in rents when the pandemic hit and more people worked from home. As people return to cities, San Franciso is seeing a growth in rental rates, albeit slower than other metropolitan areas. Something to watch out for will be lay-offs, with many high-profile technology businesses shedding staff, which could significantly slow migration and rentals in the city.

It should be noted that the market rents were always high, so any downward trends in growth are not resulting in below-market rates on rentals. For example, Sacramento enjoyed record growth in 2021 but still has rental rates significantly lower than the Bay Area.

Belong sees an average rate of $3,753.92 per month for single-family homes and condo rentals in the Bay Area market. This is a 30% premium over Sacramento, which sees an average rent of $2,733.33 per month.

San Diego

San Diego has long been a great choice for investors. With miles of picturesque coastline, a sunny climate, and a healthy economy, it’s desirable for residents, and single-family homes can attract strong returns. While it’s not the cheapest place to buy real estate, you might find better value than in many other parts of California. Also, the state’s rent control provisions are more favorable toward homeowners in San Diego than in Los Angeles.

San Diego is home to more than 1.3 million people, with a median household income of $89,457. The median monthly gross rent sits at $1,885.

For a long-time, real estate investors in the San Diego area have concentrated heavily on the short-term rental market. So much so that San Diego County has introduced new caps to make more homes available to long-term renters. Any new inventory hitting the long-term rental market can help with the supply issues, but with strong demand, rental prices aren’t taking a hit.

What’s the average rental rate in San Diego in 2023?

According to Belong’s data partners, this is the average rent in San Diego as of January 2023:

Studio: $1,825 (no change)

1-Bedroom: $2,295 (+5% YoY)

2-Bedroom: $2,995 (+2% YoY)

3-Bedroom: $3,900 (+8% YoY)

4-Bedroom: $4,945 (+12% YoY)

Belong sees an average rate of $3,526.15 per month for single-family homes and condo rentals in the San Diego market.

Rental Pricing Trends Across the Californian Market

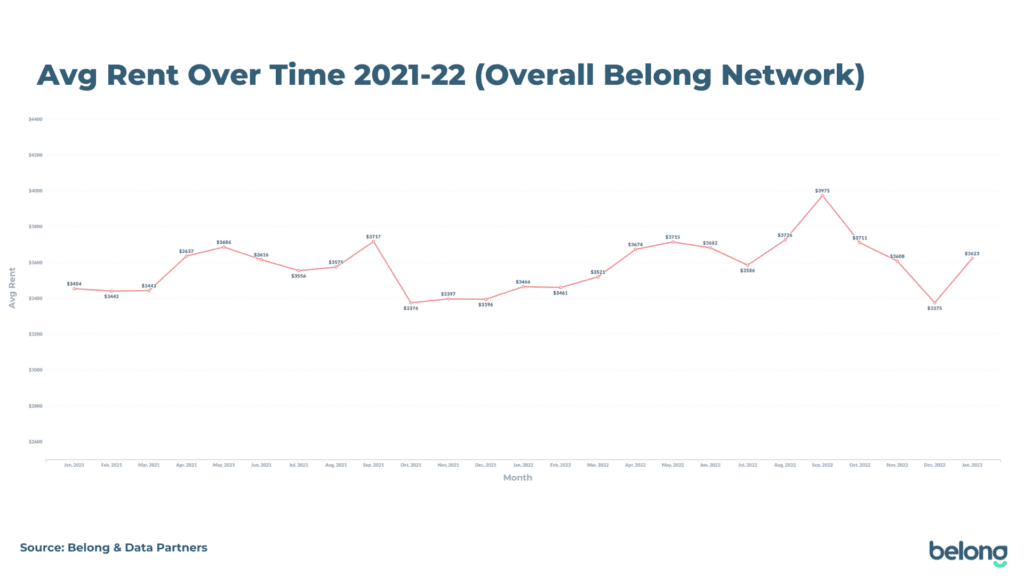

Another thing that median and average rent stats don’t account for is the seasonality of the Californian real estate market. The average rents typically peak between April and June and again in September before dropping off and hitting their lowest during the winter.

For the past two years, rents have seen consecutive growth and followed less of a seasonal pattern. However, the recent slowing of prices from October to December suggests that this is stabilizing. In 2023 and going forward, homeowners are likely to be more reliant on listings during the peak months of August-September to achieve optimal pricing for their rental property.

Below is a graph based on the average rent on the Belong network over 2021-2022. Even with increasing rents, both years see steady rises in summer, with a peak in September, before dropping off again from October.

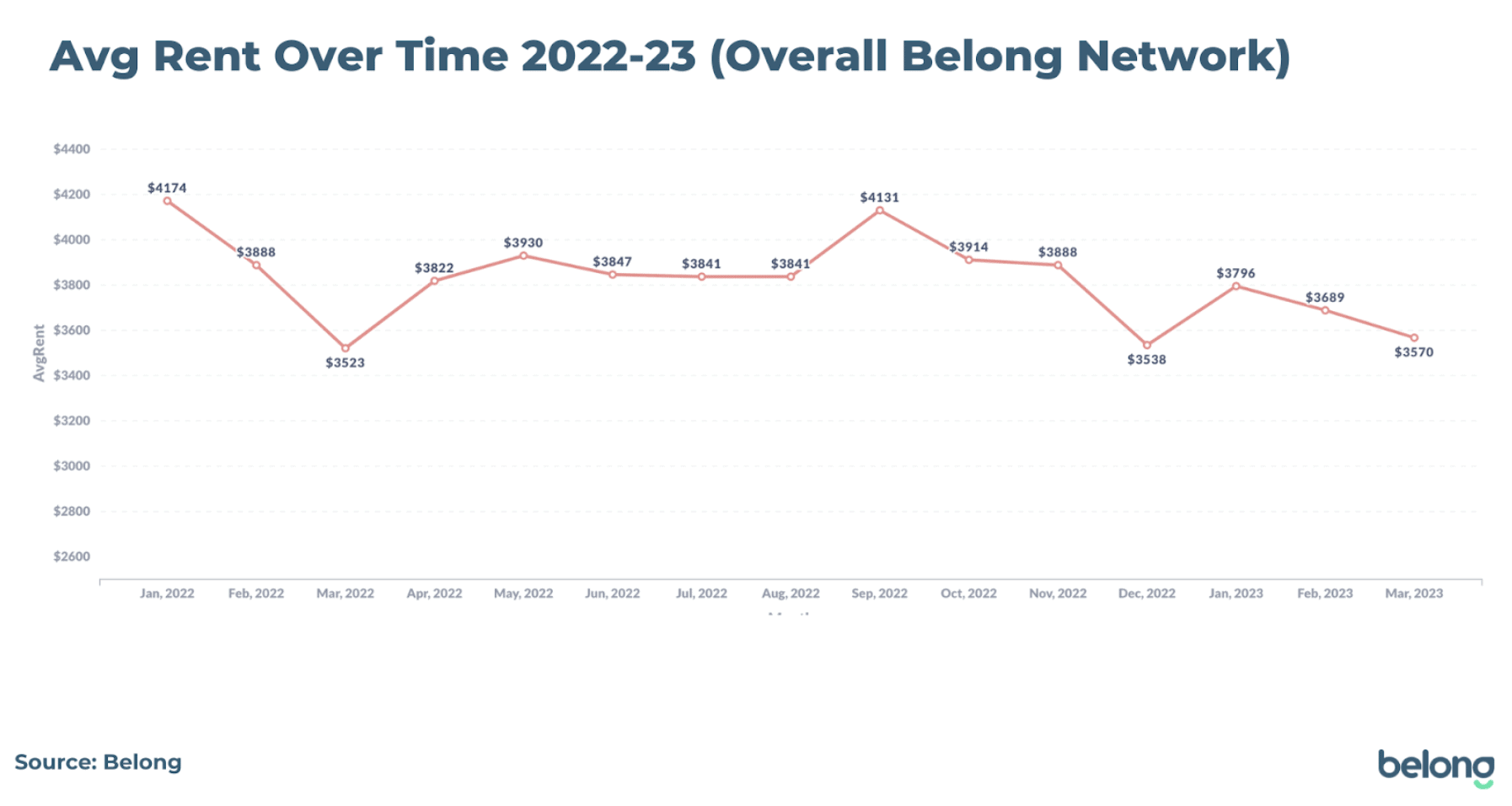

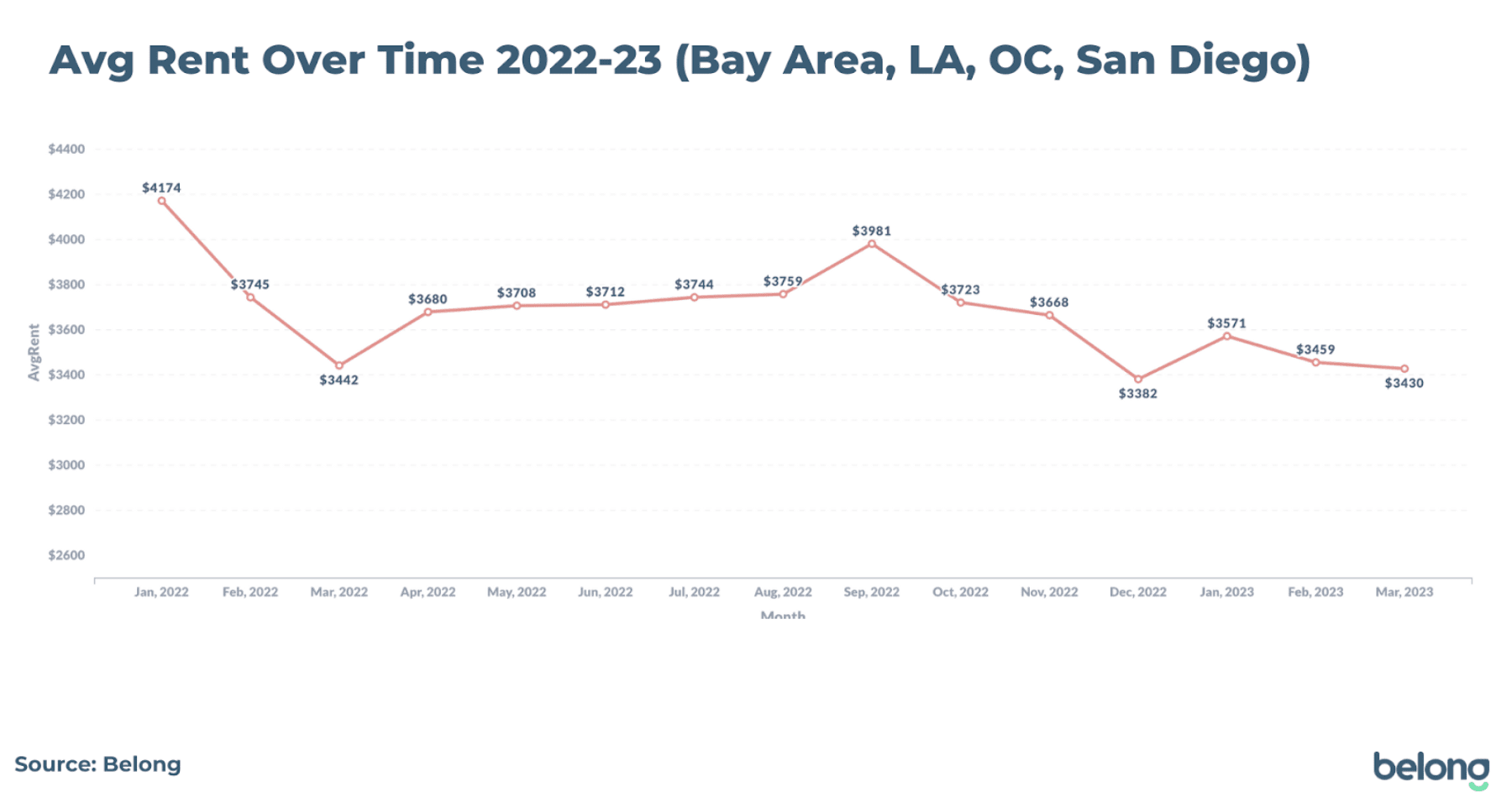

Across 2022, we can see that rents were high in January before coming down in March. They rose again in September before dropping off again. Looking ahead at the projected rents for February and March (based on leases that are yet to commence, so this is subject to change), we see that a dip is projected in March 2023, and we would expect to see a rise in April-May leading into the summer period.

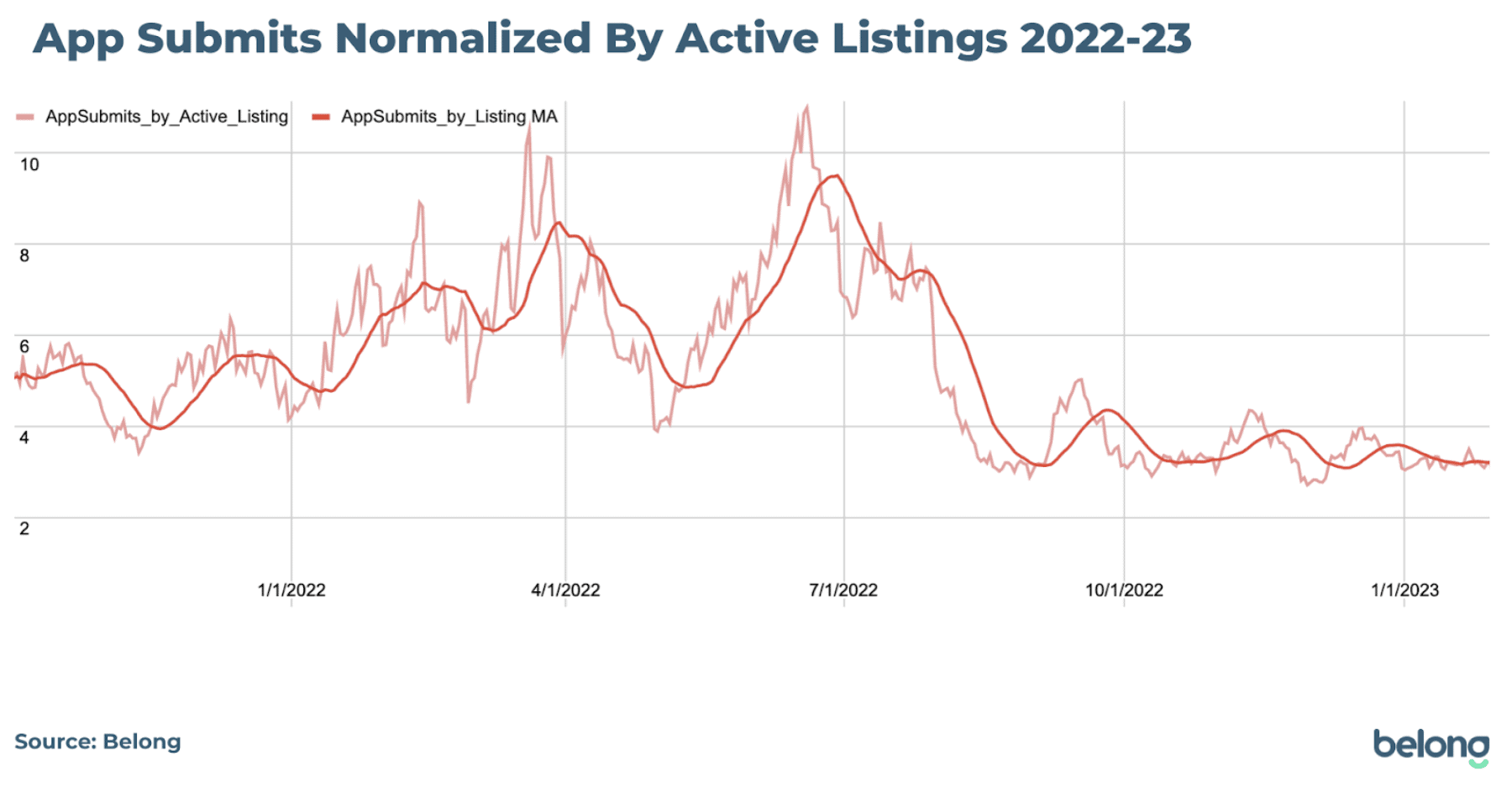

Looking at patterns of rental demand, the next chart looks at Belong’s number of rental property applications, normalized by how many active listings are on the platform. This shows that the number of rental applications/listings follows similar seasonal patterns, with rising prices not turning applicants off. Instead, the seasonal demand peaks help to buoy price increases as demand exceeds supply. When the sun is shining, homeowners can comfortably ask for more rent as competition increases on quality properties.

What is also clear is that the balance of supply and demand can turn quickly. A hot market with low vacancy can turn in a matter of weeks, as evidenced by the rapid rise in applicants/listings leading into the summer and the rapid decrease coming out of it. Practically, this means that to maximize your cash flow, you need to have a strong pulse on the market and adapt quickly.

Pro Tip: If you’re preparing your home for the rental market, work with your property manager (or an alternative such as Belong’s residential network) to get your home listed during peak months to lock in the highest possible rate to optimize your cash flow. Belong, for example, leverages real-time demand signals from the market to help maximize rental income and keep homeowners cash flow positive. If your home needs maintenance work or renovations, it would be wise to plan for this to occur between now and the winter months, when rental income is at its lowest, before putting it back on the market at the peak.

Rental Vacancy Rates in California

When it comes to determining the overall supply and demand for rentals, a great place to start is the vacancy rate. A “good” vacancy rate is a low one, around 2-4%, indicating strong demand and low supply that pushes up rental pricing. A market vacancy rate above 5% signals that there’s plenty of inventory on the market, and depending on your property type, potential residents may want to negotiate on price.

The rental vacancy rate in California was sitting at 4.1% toward the end of 2022, lower than 2021 (4.3%) but slightly higher than the start of the year, where vacancy rates were an even tighter 3.8%.

Looking at metropolitan areas, Los Angeles-Long Beach-Anaheim finished 2022 with a vacancy rate of 5.1%, which has increased significantly from 3.5%. This is coming off the back of two years of rapid rent increases and low affordability, which may have seen vacancies free up as people chose to move in with family or housemates to ease the cost of living and inflation pressures. Zillow reported a slight decrease in rental prices in December 2022. However, this could also be linked to regular seasonality and related lower demand (as evidenced by Belong’s data) rather than an influx of inventory.

In Riverside, rental vacancies remain low at 3.4%. While this is higher than at the start of 2022, where they were just 2.4%, it signals that hot rental competition remains.

In San Diego, has the new Short-Term Rental Ordinance put more inventory on the market or dented vacancy rates? It doesn’t appear that way, with vacancy rates sitting lower in Q3 than in Q1 at a low 3.1%.

Over to the Bay Area, rental vacancies are higher at 5.2%, though this is trending downward from 5.6% at the beginning of 2022.

Rental vacancy rates in California, Q3 2022:

- San Francisco-Oakland-Hayward: 5.2% (down from 5.6%)

- Los Angeles-Long Beach-Anaheim: 5.1% (up from 3.5%)

- San Jose-Sunnyvale-Santa Clara: 4.6% (up from 3.7%)

- Riverside-San Bernardino-Ontario: 3.4% (up from 2.4%)

- Sacramento-Roseville-Arden-Arcade: 3.1% (up from 3.0%)

- San Diego-Carlsbad: 3.1% (down from 3.7%)

Source: U.S. Census

As recently noted, there appears to be a “sellers strike” taking place in the U.S., with many homeowners opting to rent out their homes and rent elsewhere rather than sell and give up their low fixed-term interest rates. This could see more inventory hit the market, but also introduce more residents into the rental market. For potential investors, it means inventory could remain tight and provide less opportunity to take advantage of cooling prices.

How Real Estate Investors Can Keep Track of California’s Market

Whether you’re new to the real estate investing game, dealing with a problematic property management company, or burnt out on self-managing your rental home, BiggerPockets, and Belong can help.

From ebooks to podcasts, BiggerPockets offers educational resources for every level of real estate investment experience and strategy. When it comes to managing your home, Belong is not a property management company but a residential network offering unique services to both homeowners and their residents.

From not charging fees for the essentials to guaranteeing rent, Belong will partner with you to make owning a rental property worth it. And you’ll never need to lift a finger. Learn more and find out if your home is eligible (even if you’re mid-lease!) at belong.com/homeowners.

This article is presented by Belong

Own a rental property? Say goodbye to property management and hello to Belong. Belong brings end-to-end home management services to your fingertips.

Enjoy guaranteed rental payments, vetted residents who love your home the way you do, 24/7 support for you and your residents, innovative cash flow solutions, an industry-leading mobile app, and maximized rental value.

With Belong, you can create long-term wealth while earning passive income.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.