The relationship customers have with your business doesn’t stop after they make a purchase. If you want to maximize your revenue, you should also be aiming to maintain that relationship and keep those customers coming back for more.

And that’s where customer retention comes in.

In this roundup of customer retention statistics, we’ll be giving you the low-down on the current state of this neglected area of marketing.

We’ll be revealing useful customer retention benchmarks and sharing stats that answer important questions, such as:

- What are the biggest benefits of customer retention?

- What are the most successful customer retention strategies?

- How can you improve customer loyalty?

- What are the average customer retention rates across different industries?

- How do businesses measure customer retention?

Ready? Let’s jump into it!

Editor’s top picks – Customer retention statistics

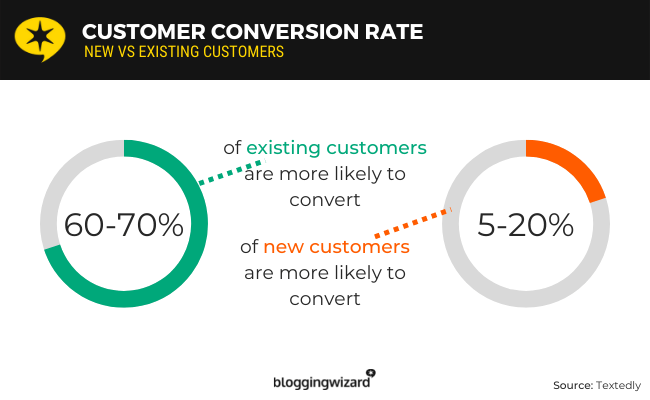

- Loyal customers are much more likely to convert than new customers. An existing customer is 60-70% more likely to convert compared to 5-20% that are new. (Textedly)

- A 5% increase in retention rate can boost profits by at least 25%. (Textedly)

- Customer retention is seven times more cost-effective compared to customer acquisition. (Neil Patel)

- Businesses spent over $75 billion on customer loyalty management last year. (Statista5)

- The main goal of customer retention is to boost spending, according to 47% of companies. (Loyalty 360)

- The average customer retention rate is approximately 75.5% across all industries. (Statista1)

- Email is the most popular customer retention channel. It’s used by 89% of marketers. (Statista4)

- Having a poor customer service experience is the number one cause of low customer retention. 71% of customers who leave a business do so because of poor service. (Neil Patel)

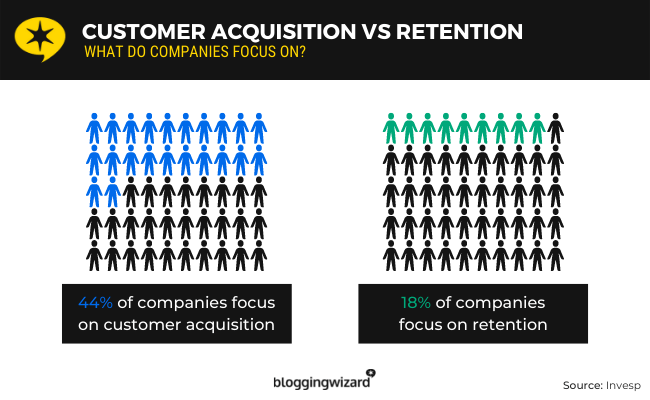

- 44% of companies focus more on acquisition while 18% focus more on retention. (Invesp)

Customer retention benefits

First, let’s take a look at some statistics that highlight the biggest benefits of customer retention.

- Existing customers are 50% more likely to try out a new product than new customers.

(Invesp)

- Existing customers have a 60-70% conversion rate…

- …whereas new customers only covert 5-20% of the time

- 80% of your business revenue comes from just 20% of your customers.

- Boosting your retention rate by 5% can increase profits by 25%-95%

- Repeat customers typically spend 33% more than new customers

(Textedly)

- The average value of a lost customer is $243

- Customer retention is 7x more cost-effective than customer acquisition

(Neil Patel)

- Your most loyal 10% of customers spend 3x more than the rest.

- Your top 1% of customers spend 5x more than the rest

(Spurr)

Needless to say, it’s clear that investing in customer retention can make a big difference to your bottom line. Not only does it increase revenues by driving repeat purchases, but it can also reduce costs as you won’t need to spend as much on customer acquisition to reach your target sales volume.

How many businesses have a customer retention program?

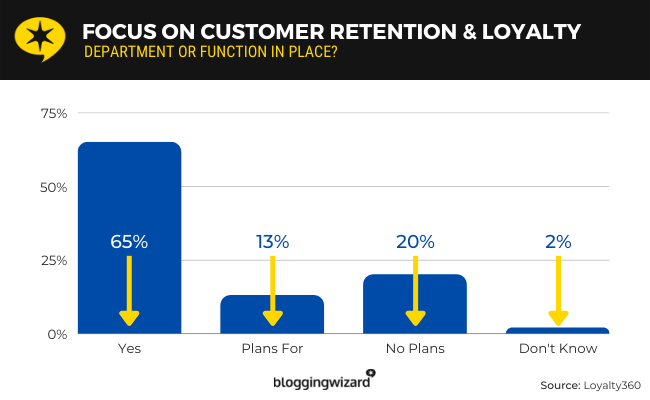

The stats show that most businesses understand the value of customer retention. According to a survey by Loyalty 360:

- 65% of surveyed companies have a specific department focused primarily on customer retention and loyalty

- And 68% of surveyed professionals rate their company’s customer loyalty/retention program as ‘somewhat effective’ or ‘very effective’

(Loyalty 360)

How much do businesses spend on customer retention?

The cost of customer retention will vary from business to business, depending on the size of your marketing budget and how much you want to allocate to customer retention efforts.

That said, we do know that on the whole:

- Businesses spent $75 billion on customer loyalty management in 2021.

(Statista5)

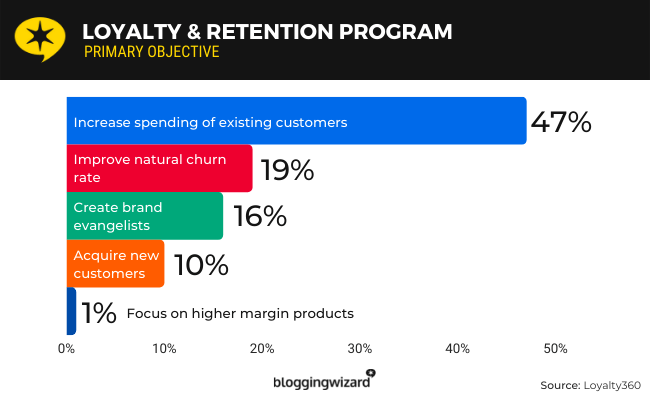

What are the main customer retention goals?

Here are some statistics that reveal what most companies and marketers are hoping to achieve through their customer retention efforts:

- 47% of surveyed professionals said the primary objective of their customer retention program is to increase customer spending

- 19% said the goal is to improve their natural customer churn rate

- 16% said the goal is to create brand evangelists

- 10% say the goal is to acquire new customers

(Loyalty 360)

The last one might seem surprising, given that customer retention and customer acquisition are usually seen as distinctly separate areas of marketing. However, they often work hand-in-hand.

For example, brands that focus heavily on customer retention create happy, loyal customers that often act as brand ambassadors. These loyal customers might share positive reviews of your business with their friends and family, and in doing so, help you to acquire new customers.

Customer retention metrics & KPIs

So we know what the main goals of customer retention are — but how do businesses measure progress towards those goals? Let’s find out by looking at some stats about the most important metrics and KPIs.

- 76% of companies think customer lifetime value (CLV) is an important metric when it comes to customer retention…

- …but only 42% can measure CLV accurately

(Invesp)

- 63% of companies look at retention and attrition rates to measure the success of their retention programs

- 57% of companies look at revenue

- 55% of companies look at customer satisfaction and customer loyalty metrics

- 34% of companies look at their net promoter score

- 25% of companies look at the number of customer saves

(Loyalty 360)

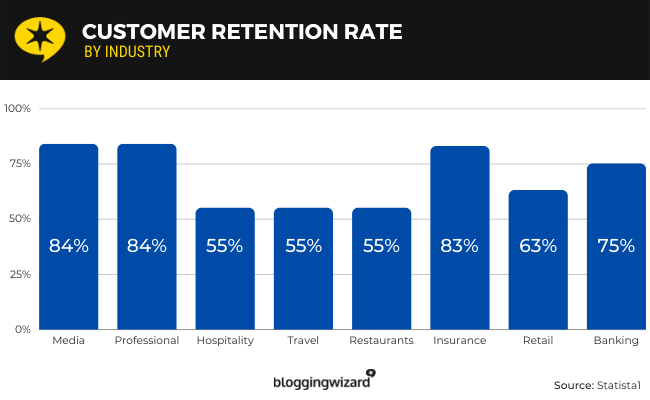

What is the average customer retention rate?

If you’re trying to measure the success of your customer retention program, it can be helpful to compare your customer retention rate to your competitors. While this metric can vary dramatically depending on the nature of your business, the statistics show that:

- The average customer retention rate across industries is around 75.5%

(Statista1)

Customer retention by industry

Next, let’s dig a little deeper and look at the average customer retention rate across different industry sectors:

- Media and professional services are the industries with the highest average customer retention rate at 84%

- Hospitality, travel, and restaurants are the industries with the lowest customer retention rate at 55%.

- Insurance businesses have an average customer retention rate of 83%

- Retail businesses have an average customer retention rate of 63%

- The banking sector has an average customer retention rate of 75%

(Statista1)

And speaking of the banking sector…

Banking customer retention statistics

Customer retention is incredibly important in the banking sector. Here are some customer retention statistics that are relevant to banks:

- 80% of banking customers will switch banks if a rival offers a better experience.

- 56% of customers who leave a bank say their bank didn’t make an effort to keep them.

- Around half of the customers who leave a bank do so within the first 90 days of opening their accounts.

The upshot: banks need to continue to invest in offering the best possible customer experience, especially to newly-acquired customers, or risk losing business to their competitors.

(ReviewTrackers)

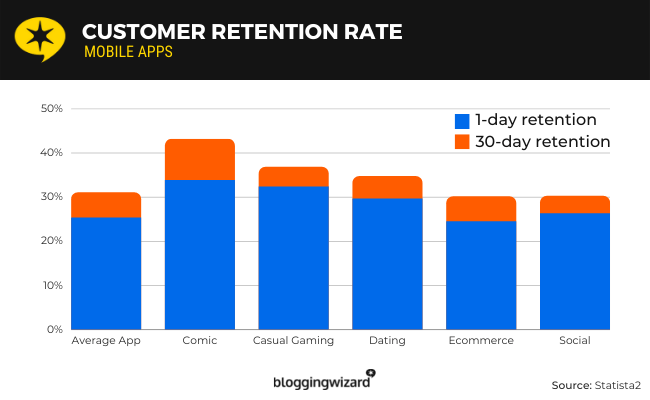

What is the average mobile app retention rate?

The average mobile app retention rates vary between different app categories. It also varies depending on the time period you measure retention across. Here are some stats that can help you to benchmark your own mobile app’s performance against the average in your industry

- The average 1-day mobile app retention rate across industries is 25.3%

- The average 30-day mobile app retention rate across industries is 5.7%

- Comic apps have the greatest 1-day retention at 33.8%

- Traditional banking apps (13.4%) and news apps (13.3%) have the greatest 30-day retention rate

- Casual gaming apps have a 1-day retention rate of 32.3%, and a 30-day retention rate of 4.5%

- Dating apps have a 1-day retention rate of 29.6%, and a 30-day retention rate of 5.1%

- Ecommerce apps have a 1-day retention rate of 24.5% and a 30-day retention rate of 5.6%

- Social apps have a 1-day retention rate of 26.3% and a 30-day retention rate of 3.9%

(Statista2)

As these statistics show, mobile app users have short attention spans. It’s tough to retain over a third of your users over 30 days, which makes it important to continually invest in acquiring new users.

What is the average customer churn rate?

Customer churn rate is a metric that’s closely related to customer retention. It tells you the percentage of customers that stop utilizing a service over a given time period and is often an important KPI for subscriber-based businesses.

Here are some stats that reveal average churn rates across industries in the US in 2020:

- Businesses in the cable and financial/credit sector had the highest churn rate at 25%.

- Big box electronics had the lowest churn rate at 11%.

- Online retail has an average customer churn rate of 22%

(Statista3)

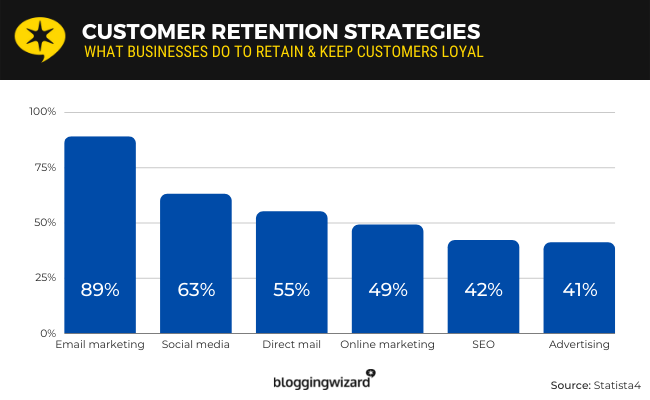

Customer retention strategies

What marketing strategies do businesses use to retain customers and boost loyalty? Let’s find out.

- 89% of marketers use email marketing for their customer retention efforts

- 63% of marketers use social media engagement for customer retention

- 55% of marketers use direct mail for customer retention

- 49% of marketers use online marketing (excluding SEO and social media ads) to retain customers

- 42% of marketers use SEO as part of their customer retention strategy

- 41% of marketers use social media advertising as part of their customer retention strategy

(Statista4)

That’s the data according to Statista, but other surveys have revealed other strategies and marketing channels that businesses use to deliver their customer retention messages. For example, Invesp found that:

- 22% of marketers use web retargeting for customer retention

- 39% of marketers use mobile and web push notifications for customer retention

- 58% of marketers use mobile messaging for customer retention

- 52% of marketers use email for customer retention

(Invesp)

What causes low customer retention?

Wondering what’s causing you to lose so many customers? Here are some customer retention statistics that might shed some light on the problem:

- 71% of customers have ended a relationship with a brand due to poor customer service.

- US companies lose $83 billion due to poor customer service every year

- 68% of customers leave because they’re unhappy with the way they were treated

- 14% of customers leave because they’re dissatisfied with the product or service

- 9% of customers leave because they move over to a competitor instead

(Neil Patel)

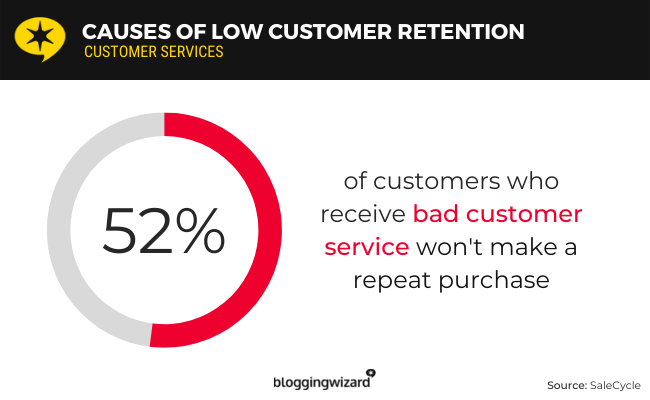

- 52% of customers won’t make a repeat purchase if they have a bad customer service experience.

(SaleCycle)

As these statistics show, customer service problems are the main reason businesses suffer from low customer retention—by a wide margin. Even if your product is outstanding, you can bet you’ll still be losing customers if you’re not delivering the kind of service they expect.

What causes good customer retention?

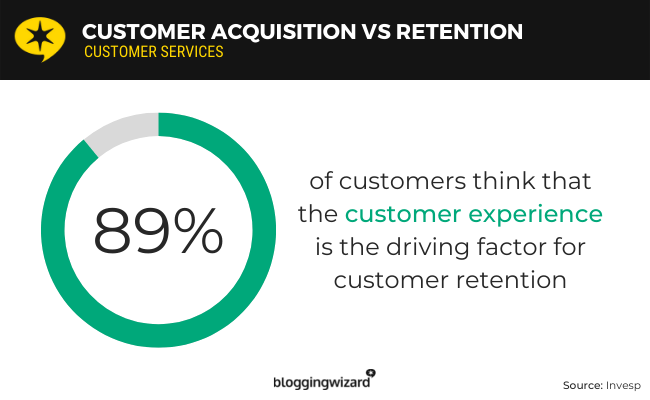

Unsurprisingly, the data also shows that offering excellent customer service is the easiest way to boost customer retention:

- 89% of customers think that the customer experience is a key factor in driving customer retention

(Invesp)

If you’re running an ecommerce store, offering a fair and hassle-free returns policy is another easy way to boost your retention rate:

- 92% of consumers will make repeat purchases if returns are easy

(Invesp2)

Customer retention vs acquisition statistics

Should you be investing more of your time and effort into acquisition or retention? It’s an important question—here’s what the statistics show:

- Most companies are focused more on customer acquisition (44%) than on retention (18%)

- Around 40% of companies focus equally on customer acquisition and retention

- 30% of agencies focus equally on acquisition and retention

(Invesp)

Based on these numbers, it’s safe to say that in most cases, you should probably still be investing more in generating new leads than driving repeat purchases.

Customer loyalty program statistics

Customer loyalty programs are one of the most popular and effective customer retention strategies. It’s a way to directly incentivize your customers to stay loyal, by offering them rewards based on the amount of time they buy from or engage with your brand.

Here are some customer retention statistics related to loyalty programs.

- 45% of diners will eat at a restaurant again if they’re part of its loyalty program.

(Hospitality Tech)

- Customers are 80% more likely to make repeat purchases if they’re part of a loyalty program

(Spurr)

- The average US consumer belongs to 16.6 loyalty programs (but actively uses less than half of them)

(Statista6)

Customer retention statistics sources

Customer retention statistics: Final thoughts

That concludes our roundup of the latest customer retention statistics. We hope you found them useful and informative!

While you’re here, you might want to take a look at some of our other stats roundups. We’ve got ecommerce statistics, content marketing statistics, conversion rate optimization statistics, and a whole lot more! Check them out to brush up on your marketing knowledge.