I wrote an article explaining why I am investing in real estate investment trusts (REITs) instead of rental properties. In short, REITs are still discounted, and I expect their lower valuations to result in higher returns in the coming years.

Unfortunately, it would seem that many readers miss the point of investing in REITs due to misconceptions. I saw several people in the comment section claim that REITs should be less rewarding investments because:

- You don’t enjoy the benefits of leverage.

- They are not tax-efficient.

- You are paying managers instead of getting your hands dirty.

But these statements are just plain wrong, and I am going to prove it.

The Studies Bear It Out

Studies show very clearly that REITs are more rewarding investments than private real estate in most cases, and there are good reasons for this. This may seem surprising to some of you, but it really shouldn’t be. Here are three examples.

Study 1

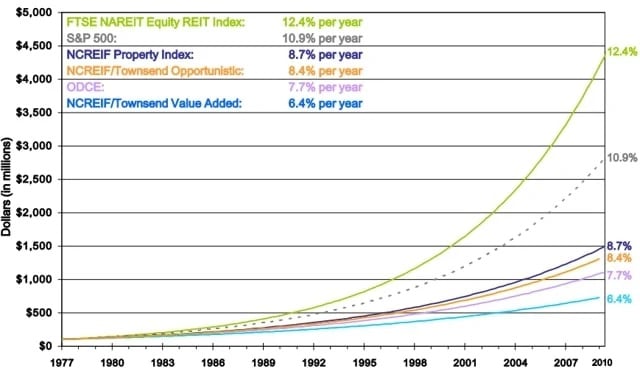

FTSE Equity REIT Index compared to NCREIF Property Index as an annual return percentage (1977-2010) – EPRA

Study 2

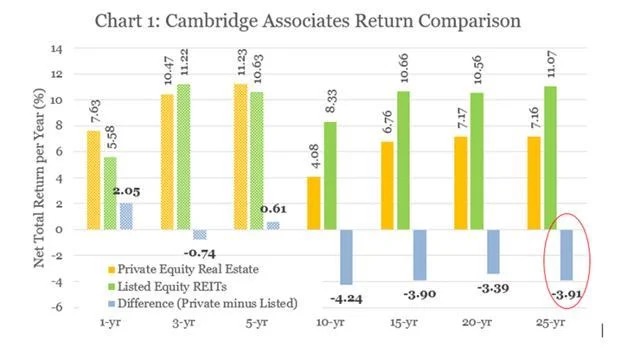

Private Equity Real Estate compared to Listed Equity REITs as net total return per year over 25 years – Cambridge Associates

Study 3

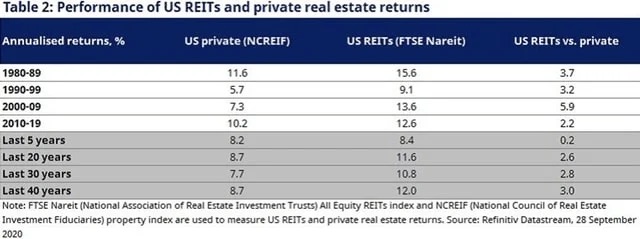

Performance of U.S. REITs and Private Real Estate Returns (1980-2019) – NAREIT

Three Misconceptions and Why They’re False

I will give you eight reasons why REITs should be more rewarding investments than private real estate in most cases. But before that, I will quickly correct the three misconceptions that I keep hearing over and over again:

Misconception 1: You don’t enjoy the benefits of leverage.

This is nothing more than a misunderstanding. Investors seem to think that just because you cannot take a mortgage to REITs, you won’t enjoy the benefits of leverage, but this is incorrect.

What they ignore is that REITs are already leveraged. You don’t need to take a mortgage because REITs take care of that for you.

When you buy shares of a REIT, you are providing the equity, and the REIT adds debt on top of it. As such, your $50,000 investment in the equity of a REIT may well represent $100,000 worth of properties. You just don’t see it because what’s traded in the stock market is the equity, not the total asset value, but the benefits are the same.

Misconception 2: They are not tax-efficient.

This misconception stems from the fact that REIT dividend payments are often classified as ordinary income. But this is very short-sighted because there are many other factors that improve their tax efficiency—to the point that I pay less taxes investing in REITs than in rentals:

- REITs pay zero corporate taxes, so there is no double taxation.

- REITs retain 30% to 40% of their cash flow for growth. All of that is fully tax-deferred.

- A portion of the dividend income is commonly classified as “return of capital.” That’s tax-deferred as well.

- The portion of the dividend income that’s taxed enjoys a 20% deduction.

- REITs generate a larger portion of their total returns from growth because they focus on lower-yielding class A properties. The appreciation is fully tax-deferred.

- Finally, if all that still isn’t enough, you can hold REITs in a tax-deferred account and pay zero taxes with great flexibility.

Beyond that, REITs also have enough scale to have in-house lawyers to fight off property tax increases and optimize their impact.

All in all, REITs can be very tax-efficient.

Misconception 3: You are paying managers instead of getting your hands dirty.

Yes, you are paying managers, but the management costs of REITs are still far lower than that of private rental properties because they enjoy huge economies of scale.

Taking the example of Realty Income (O), its annual management cost is just 0.28% of total assets. There are huge cost advantages when you own billions of dollars worth of real estate, and REIT investors benefit from this.

Now that we have these misconceptions out of the way, here are the eight reasons why REITs are typically more rewarding than rental properties:

Reason 1: REITs Enjoy Huge Economies of Scale

It goes far beyond just management cost. Real estate is a low-margin business, with low barriers to entry. Therefore, scale is a major advantage to lower costs and improve margins. REITs excel at this.

Take the example of AvalonBay Communities (AVB). The REIT owns nearly 100,000 apartment units, resulting in significant economies of scale at every level, from leasing to maintenance and everything else in between.

Let’s assume that AVB owns 500 apartment units in one specific market, and it strikes a deal with a local contractor to change 100 carpets each year. It will of course get a much better rate for each carpet than what you could get if you made a deal to change just one.

Another good example would be if you need to hire a lawyer to evict a tenant. AVB has in-house lawyers working for them, which greatly reduces the cost.

Such economies of scale apply everywhere, and it makes a big difference in the end.

Reason 2: REITs Can Grow Externally

Private real estate investors are mostly limited to rent increases to grow their cash flow over time. We call this “internal growth” in the REIT sector. But REITs can also supplement their internal growth with what we call “external growth,” which is when they raise more capital to reinvest it at a positive spread.

That’s how REITs like Realty Income have historically managed to grow their cash flow and dividends at 5%+ annually, even despite only enjoying annual 1% to 2% annual rent increases. The difference comes from external growth.

It sells shares in the public open market to raise equity and then adds debt on top of it and buys more properties. As long as it can raise capital at a cost that’s inferior to the cap rates of its new acquisitions, there is a positive spread that will expand its cash flow and dividend on a per-share basis. It is not dilutive. It is accretive and creates further value for shareholders.

Private real estate investors cannot do that because they don’t have access to the public equity markets, putting them at a significant disadvantage right off the bat.

Reason 3: REITs Can Develop Their Own Properties

Most private real estate investors will buy stabilized properties and rent them out. At most, they may do some light renovations in an attempt to increase the value and rent.

But REITs go far beyond that. They are very active in their investment approach and will commonly buy raw land, seek permits, and build their own properties to maximize value.

It is not uncommon for REITs like First Industrial (FR) to build new class A industrial properties at a 7%+ cap rate, but if it bought such stabilized assets, it would only get a 5% cap rate. That puts it at a huge advantage. Not only will it earn a higher yield from newer properties, but it will also create significant value by raising capital and developing these assets.

REITs can do this because of their scale. They can afford to hire the best talent and tend to have great relationships with city officials, tenants, and contractors.

Reason 4: REITs Can Earn Additional Profits by Monetizing Their Platform

REITs will commonly also earn additional profits by offering services to other investors, and you participate in these profits as a shareholder of the REIT.

Many REITs will manage capital for other investors and earn asset management fees. As an example, they may create joint ventures when acquiring properties and let other investors ride their investments, charging them fees for managing them, boosting the return that the REIT earns on its own capital. Healthcare Realty (HR) commonly does that.

Alternatively, the REIT may offer brokerage or property management services. Some are so active in developing properties that they have their own construction crew and offer construction services to earn additional profits. Naturally, this also boosts returns for REIT shareholders.

Reason 5: REITs Enjoy Stronger Bargaining Power With Their Tenants

REITs are large and well-diversified, and this puts them in a stronger position when negotiating with tenants. This is key to earning stronger returns over time because it commonly allows the REIT to achieve faster rent growth.

If you only own just one or a few properties, you will be reluctant to raise the rent out of fear that your tenant will move out. You are not well-diversified, so a vacancy would be very costly.

However, REITs can enforce rent increases because they know that they will be just fine if the tenant moves away. It won’t have a big impact on their bottom line, and they have the resources to quickly release the property at a minimal cost.

Reason 6: REITs Benefit from Off-Market Deals on a Much Larger Scale

Most often, when private real estate investors buy a property, they will do so via the brokerage market. The properties are advertised for sale, they are priced competitively, and you also end up paying high transaction costs.

Again, the scale of REITs gives them a major advantage, as they will commonly skip the brokerage market and structure their own off-market deals.

Some REITs, like Essential Properties Realty Trust (EPRT), will reach out to property owners via cold-calling efforts and offer to buy their real estate. They will then structure their own leases with landlord-friendly terms and typically close the deal at a higher cap rate than what they would have gotten in a more competitive bidding environment.

Reason 7: REITs Have the Best Talent

I briefly mentioned this earlier, but it is worth mentioning it again: REITs can afford to hire the best real estate talent because of their large scale.

Even despite paying them handsomely, their management cost is still far lower as a percentage of assets than what it typically is for private properties. And there’s no doubt that better skills will result in better returns over time.

These people go to the top schools, gain the best private equity experience, and eventually dedicate their lives to working long hours for the benefit of REIT shareholders. You cannot compete with them, especially if you are just a part-time landlord.

Reason 8: REITs Avoid Disastrous Outcomes

Finally, another important reason why REITs outperform on average is that they avoid disastrous results for the most part. The distribution of results is much wider for private real estate owners.

Some will succeed. Others will lose it all. They are highly concentrated, leveraged private investments with liability risk and a social component. Not surprisingly, there are countless real estate investors filing for bankruptcy each year, and these disastrous results hurt the average performance of private real estate investors.

But REIT bankruptcies are extremely rare. There have only been a handful of them over the past few decades, and most of them were REITs that owned lower-quality malls.

This shouldn’t come as a surprise, given that most REITs use reasonable leverage, are well diversified, and own mostly Class A properties. It is really hard to then mess it up.

Final Thoughts

REITs are typically more rewarding than private real estate investments. Studies prove this, and there is a strong rationale as to why this would make sense. In fact, it would be surprising if it were the opposite, given all the advantages that REITs enjoy.

However, this doesn’t imply that private real estate is a poor investment; rather, it highlights the importance of not overlooking REITs and including them in your real estate portfolio.

Invest Smarter with PassivePockets

Access education, private investor forums, and sponsor & deal directories — so you can confidently find, vet, and invest in syndications.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.