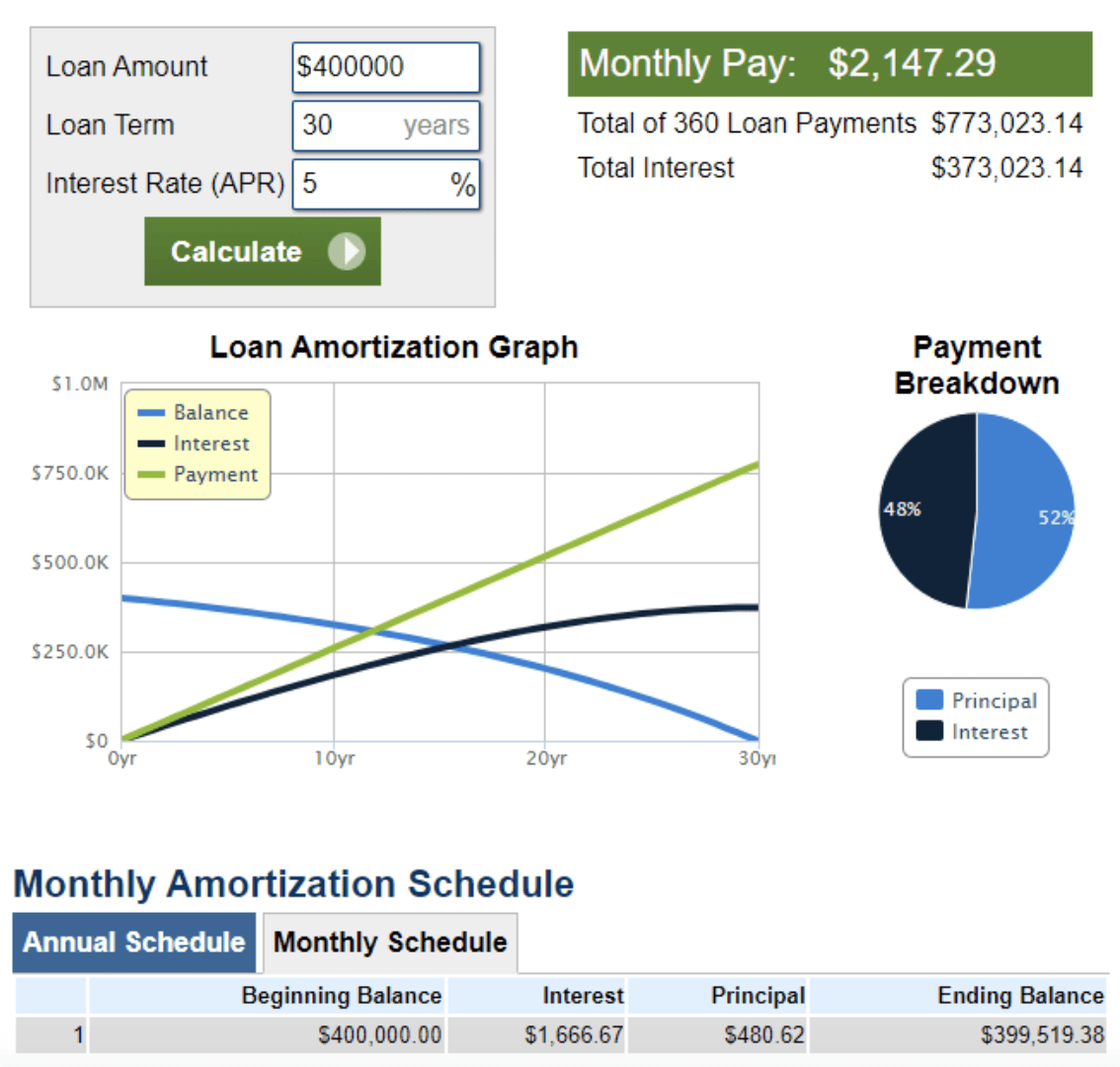

Calculating the principal and interest on your loan helps you identify the actual cost of a property. If you have a $400,000 loan at a 30-year fixed rate of 5%, the amount you spend after 30 years isn’t $400,000. It’s actually $773,158. $400,000 will go toward your principal, while the other $373,158 will go toward your interest.

When you buy a home with a fixed interest rate, your monthly mortgage payment will be the same for the duration of your loan. However, even though you’re writing a check for the same amount every month, how much you put toward your principal and interest will always be different.

In this post, we’ll define what your principal and interest payments are on a mortgage and show you have to calculate how much a house will cost you to make a more informed decision when purchasing a property. We’ll also discuss the difference between APR and your interest rate, what factors impact your interest rate, and how to track where your fixed-rate mortgage payments are going.

Here’s how to calculate the principal and interest on your loan:

What is the Principal on a Mortgage?

When you take out a home loan, your principal is the amount you borrow from a lender. If the total purchase price of your home is $300,000 and you make a 20% down payment of $60,000, the remaining $240,000 is your principal balance.

Purchase Price – Down payment = Principal balance

Use our mortgage calculator to determine how much home you can afford. Your principal equates to your loan amount, making it one of the most important numbers to know. Your mortgage principal starts accumulating interest right after you take out your loan. Combined, the two make up most of what you’ll pay monthly.

What is an Interest Payment?

Lending institutions don’t loan you hundreds of thousands of dollars and get nothing in return. Your lender charges you interest on the loan, usually based on the annual percentage rate (APR).

Most first-time home buyers are surprised to learn that, even with a low-interest rate, they’ll be spending a lot of money toward the mortgage interest each month. For example, if you take out a 30-year loan for $400,000 at a 5% interest rate, your monthly payment is $2,147.29. For the first month, $1,666.67 of that payment goes towards interest, and only $480.62 goes toward paying down your principal.

How is Your Interest Payment Calculated?

Calculating your interest payment requires a little more math. The formula is:

Monthly Interest Payment = Principal Loan Amount x (Annual Interest Rate / 12)

Principal loan amount = $400,000

Interest rate = 5%, or 0.05

In this case, your interest is:

Interest = $400,000 x (.05/12)

Interest = $1,666.67

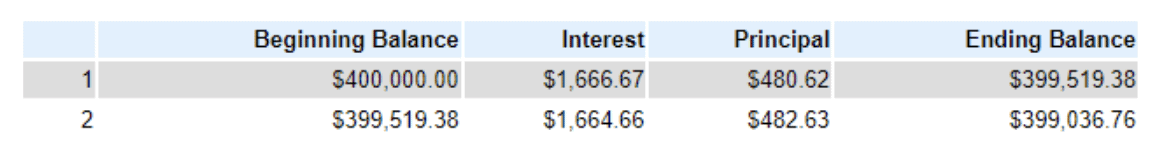

With a fixed rate, you’ll pay less interest with each mortgage payment because your principal balance decreases. After your first mortgage payment, your principal balance goes from $400,000 to $399,519.38. For month two, your interest equation is:

Interest = $399,519 x (.05/12)

Interest = $1,664.66

While you only end up putting $2.01 more toward your principal balance, you’ll slowly pay down more and more of your loan over time, which brings us to amortization.

What is Amortization?

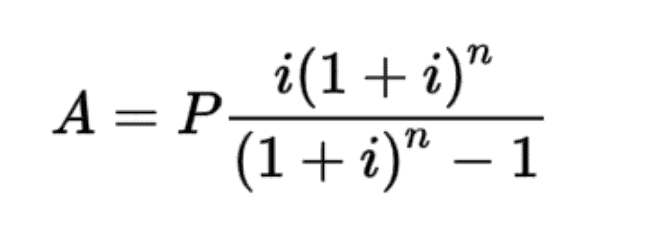

Amortization means paying off your home loan through regular principal and interest mortgage payments over time. Calculating amortization requires using the formula:

A = Monthly Mortgage Payment

P = Principal Balance

I = Periodic Interest Rate

N = Total Number of Payments

We recommend using an amortization calculator instead.

Why Amortization Matters

Amortization helps homeowners and real estate investors identify their costs over time.

For tax purposes, amortization tables show you how much you’ll pay in interest each year. Mortgage interest is tax-deductible, meaning you claim it if you itemize your expenses and surpass the standard deduction threshold.

Amortization also shows how much you’ll owe on your principal balance each year or month. The lower your balance, the more equity you have in your home. To keep it simple, let’s assume your home never increases in value. Before you make your first payment, you have $100,000 in equity (a.k.a. Your down payment).

Using the above example, here’s how much your principal balance is at various time intervals:

| Month/Year | Initial Down Payment | Balance | Equity |

| 0 months / 0 years | $100,000 | $400,000 | $100,000 |

| 12 months / 1 year | $100,000 | $394,098.54 | $105,901.46 |

| 60 months / 5 years | $100,000 | $367,314.93 | $132,685.07 |

| 120 months / 10 years | $100,000 | $325,368.26 | $174,631.74 |

| 180 months / 15 years | $100,000 | $271,535.63 | $228,464.37 |

| 240 months / 20 years | $100,000 | $202,449.07 | $297,550.93 |

| 300 months / 25 years | $100,000 | $113,786.23 | $386,213.77 |

| 360 months / 30 years | $100,000 | $0 | $500,000 |

In this scenario, you build more equity the longer you have the loan. This is because more mortgage payments go toward your monthly principal balance.

APR vs. Interest Rate: What’s the Difference?

Both rates are expressed as a percentage, but there’s a key distinction between them.

Your interest rate refers to the annual cost of your loan but doesn’t reflect any fees or charges you might have to pay for the loan.

Your APR is a more holistic expression of what you’re borrowing and is often higher than your interest rate. It reflects your interest rate, mortgage broker fees, any mortgage points, and other charges you incur to get your loan.

What Factors Impact Your Interest Rate?

The lower your interest rate, the less your monthly mortgage payments will be—and every percentage point counts! For your $400,000 30-year loan at 5%, your monthly payment is $2,147. However, if your interest rate is 4%, your monthly payment drops to $1,910. That’s a $237 difference!

Here are a few factors that determine your interest rate:

- Credit Score: The higher your FICO score, the lower your interest rate. You’ll typically qualify for the best rates if your credit score is in the 700s or higher.

- Loan Term: If your loan is for a shorter term, your interest rate will likely be lower. If you qualify for a 30-year loan at 5%, the same lender might offer you a 15-year loan at 4%.

- Location: If you’re in an area where more homeowners default, your interest rate may be higher.

- Down Payment: If your down payment is less than 20%, most loans require you to pay private mortgage insurance (PMI), which is an additional 0.58% – 1.86% added interest.

- Current Interest Rates: The state of the housing market and the Federal Reserve impact home loan rates.

What Else is Included in Your Monthly Mortgage Payment?

Your principal and interest make up the base of your monthly mortgage payment, which won’t increase during the duration of your loan. However, there are other fees to consider:

- Property Taxes: These taxes are what your local government charges you based on the assessed value of your property. The assessed value is what a property assessor says your home is worth and is not the same as the market value. Property taxes vary from state to state.

- Homeowner’s Insurance: Homeowner’s insurance usually covers internal and external damage to your home, the loss or damage of personal assets, and liability coverage if an accident occurs in your home or on your property.

- PMI: As mentioned earlier, you must pay PMI if your down payment is less than 20%. This insurance protects your mortgage lender if you don’t pay your mortgage. It goes away when your loan-to-value (LTV) ratio drops to 78% or lower.

- Homeowner’s Association (HOA) Dues: If you move into a condo or neighborhood with a homeowner’s association, you must pay HOA fees. These vary based on your HOA.

Keeping Track of Your Principal and Interest

To recap, your principal is the amount you borrow from a lender when taking out a home loan, and your interest is what a lender charges you to borrow that money. Now that you know how they work and how to use an amortization calculator to see how much you’re paying and when you can make a more informed decision when buying a home.

FAQs

Should You Pay the Principal or Interest?

Depending on the terms of your loan, you can pay more each month. The extra money goes toward your principal balance and helps you repay your loan faster.

How Else Can You Pay Your Loan Off Faster?

Some companies will let you make biweekly mortgage payments. Instead of making 12 monthly payments, you’ll earn 26 biweekly payments that are equal to half your monthly amount. With this strategy, you’ll pay an extra month each year and can shave several years off your loan.

What Percentage of Payment is Principal?

This percentage varies based on your loan length, amount, and interest rate.

Join the Community

Our massive community of over 2+ million members makes BiggerPockets the largest online community of real estate investors, ever. Learn about investment strategies, analyze properties, and connect with a community that will help you achieve your goals. Join FREE. What are you waiting for?

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.