We are in a housing correction. It remains to be seen what this means for prices in the national housing market, but some trends are becoming clear. We can gather important insights from these trends to inform our investing strategy and help us all navigate and earn great returns during the correction.

The National Housing Market Has Peaked

First and foremost, the national market has likely peaked in absolute terms. In plain English, most markets hit their all-time highs in June and have started to come down month-over-month since then. The housing market is seasonal, and prices typically peak in the summer and then start declining in absolute terms. But peaking in June is a little early and reflects the beginning of a correction, in my opinion.

Due to this seasonality, the housing market is often measured in year-over-year terms (i.e., what happened in August 2022 vs. August 2021.) When we look at the national housing market this way, it is still up about 6% year-over-year. That would be considered rapid appreciation in a normal year, but this represents a massive deceleration from the growth rates we’ve seen over the last few years. Just a few months ago, in May 2022, year-over-year appreciation was over 15%!

Of course, everyone wants to know if the national housing market will turn negative year-over-year, but we just don’t know. In terms of where we’ll end 2022, I think it’s a toss-up. We’ll either see very modest growth rates or slightly negative growth rates for the national housing market at year’s end. It is worth noting that in August, San Francisco and San Jose, California, were the first two markets to show year-over-year declines. In terms of 2023—it’s too hard to tell right now.

The Real Story is Within Individual Markets

The above answer about the national housing market might not be satisfying, but in some ways, what happens with the national housing market doesn’t matter. Well, it matters, but by only paying attention to the national housing market, you miss the most important story about the housing market: the discrepancy between markets.

In some markets, dynamics have barely changed and still look like a strong seller’s market. In others, the shift towards a buyer’s market has been dramatic.

To measure this, I like to look at two lead indicators for housing prices: inventory and days on market (DOM). When either of these metrics is low, it indicates a seller’s market. When they are high, they indicate a buyer’s market.

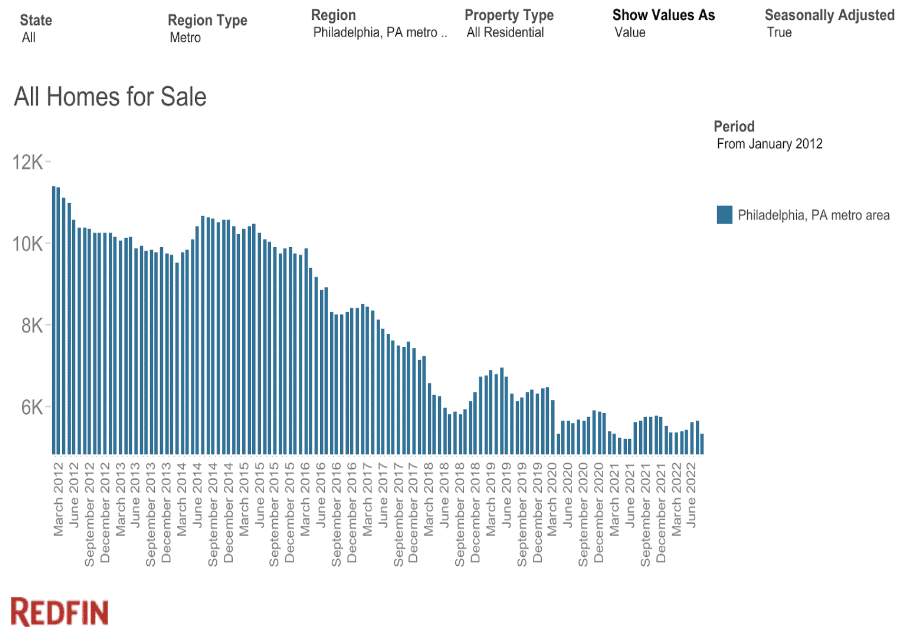

First, let’s take a peek at Philadelphia, Pennsylvania. In the chart below, you’ll see that inventory remains extremely low in a historical context and hasn’t really increased at all—indicating this metro area is still in a seller’s market.

Philly isn’t alone. Many cities (predominantly in the midwest and northeast) look this way. Check out Boston, Massachusetts; Chicago, Illinois; Hartford, Connecticut; Cincinnati, Ohio; Madison, Wisconsin; and the many others still seeing pandemic-level inventories.

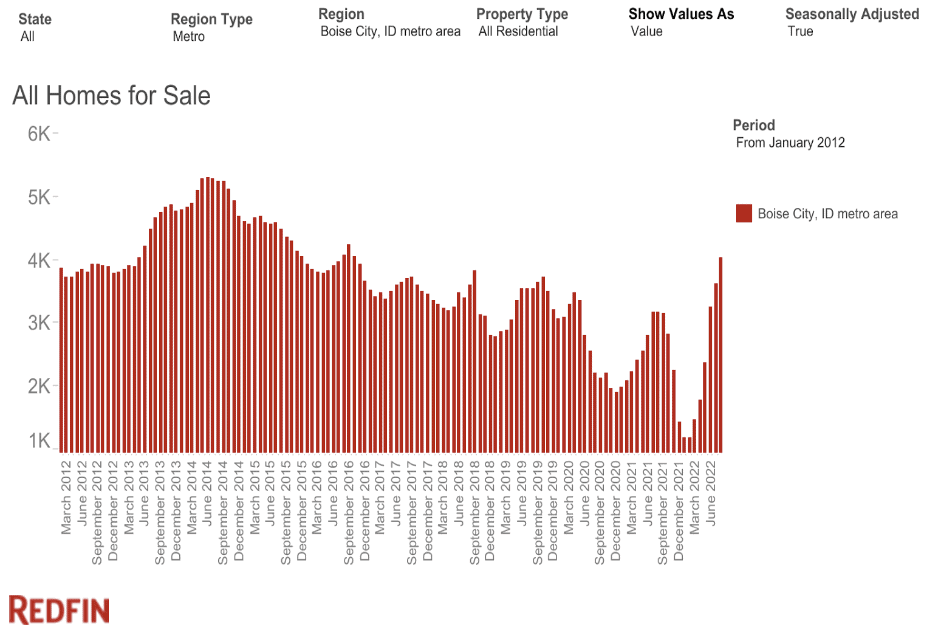

On the other hand, let’s look at some of the “winners” of the pandemic era. Below is the monthly inventory graph for Boise, Idaho, one of the poster children of rapid appreciation. Notice a difference here? Not only has inventory started rising, but it’s also risen above pre-pandemic levels. This strongly indicates that Boise has shifted to a buyer’s market. Other cities seeing rapidly rising inventory are low-affordability cities like Austin, Texas; Las Vegas, Nevada; San Francisco, California; and San Jose, California.

We don’t know what will happen with prices in these markets, but it can be helpful to look at lead indicators like inventory and DOM to get a sense of the varying dynamics. I recommend everyone reading this goes and does some research on their own market. Redfin has a great tool for this.

However, I want to caveat this data by explaining that these metrics only describe the current situation and provide an outlook for the next few months. Inventory and days on market say nothing about the long-term prospects of any of these markets. For that, you need to understand population growth, supply and demand, and job/wage growth.

I call this out because many markets that are now seeing the biggest potential for correction are cities that may still be good long-term opportunities. Austin is a perfect example of this. Austin grew really quickly over the last few years, and for good reason! The city has enormous economic and population growth and shows no signs of slowing down. But, perhaps home prices grew too quickly and could see a “reset” in prices (declines) before starting to grow again (probably when interest rates go down again, at some point.)

On the other hand, some markets that are more “stable” at the moment, like Chicago, have seen modestly declining populations over the last few years, which could hamper future price growth.

Overall, Housing Prices Are Set to Decline

Overall, I think we’re likely to see housing prices decline in absolute terms over the coming months. Rising interest rates have depleted affordability in the market. With recent events and persistent inflation, it seems that rates will stay high for the foreseeable future. I am not convinced the national market can withstand sustained downward pressure exerted by low affordability. Something has to change, and if rates stay high for a while, as it now seems they will, the thing that has to change is housing prices.

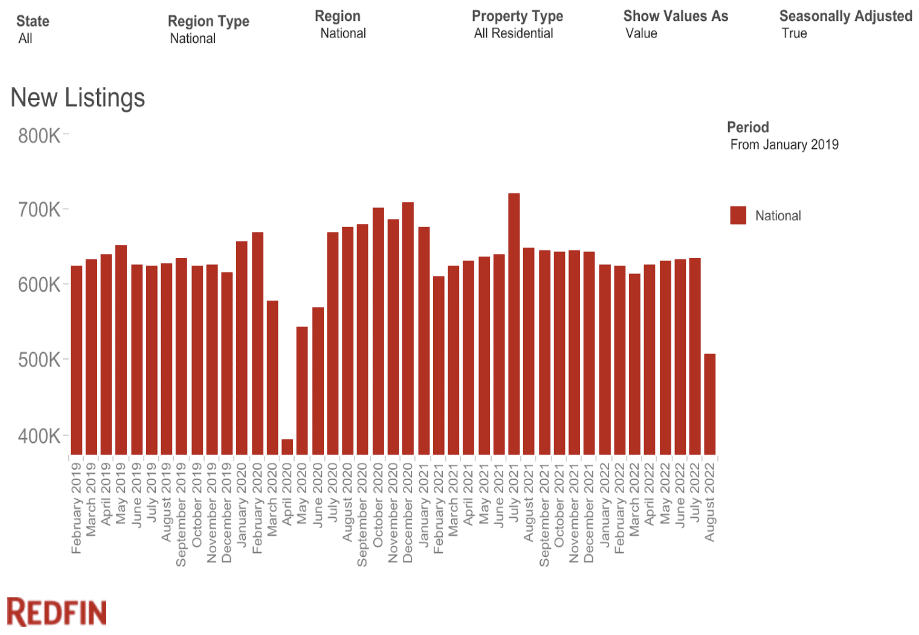

That said, I still don’t think we’ll see a “crash” (declines greater than 20%.) There are a lot of reasons for this, such as better lending practices, long-term supply shortages, etc. But one emerging trend that could provide a backstop for price declines is a sharp drop-off in new listings.

This graph is very telling (take note of the scale on the vertical axis, but still!) People just don’t want to sell their houses right now. The housing market is not the stock market, and when homeowners are faced with the prospect of selling into an adverse market, they just opt out.

Unlike in 2008, the vast majority of Americans are in a good position to service their debt. Many Americans will opt to stay in their homes and wait out the rough market. This is particularly appealing because over half of American homeowners have mortgage rates under 4%. Who wants to sell into a declining market, only to have to rebuy with a much higher interest rate? It seems like many homeowners are rejecting that idea.

That’s how I see the market right now. Market dynamics are changing rapidly, but I hope sharing my current read on the housing market is helpful to you. The market is cooling off rapidly, and there is a huge variance between regional markets, but a “crash” remains unlikely. Just for reference, most forecasters see the national housing market landing somewhere between +3% and -8% in 2023 on a year-over-year basis. Not a crash, but there is potential for a significant correction.

11 Ways to Invest During the Housing Correction

The question then becomes, how do you invest in this type of market? Here are a few of my thoughts:

1. Invest in hybrid cities

Ideally, cities that offer decent cash flow, are seeing stable prices right now, and have decent long-term prospects. These are often smaller cities like Madison, Wisconsin; Birmingham, Alabama; and Virginia Beach, Virginia.

2. Negotiate with sellers

Negotiate! If you want to invest in markets with great long-term prospects, look for under-market deals. Once prices start to drop, sellers sometimes panic, and you can often find value. The data might not show this, but every experienced investor I know says that sellers are willing to negotiate right now. If you can buy below market rates, that offsets the risk of modest declines in the coming months. In this type of market, it’s more important than ever to use an investor-friendly agent who can help you navigate local market dynamics. BiggerPockets can help you find one for free—just use the link above.

3. House hack

House hacking is pretty much always a good option, in my opinion.

4. Stay away from flipping

Don’t start flipping houses. I don’t flip houses, so I’m biased, but I wouldn’t advise anyone to start right now. There is market risk, labor risk, and material cost risk. Experienced players are probably still doing well, but I don’t think it’s a good time for newbies to start flipping.

5. New construction might be lucrative

Prices on newly constructed homes are likely to decrease more than existing homes and could provide a relatively good value for long-term investors. Traditionally, new construction isn’t a great option for rental property investors, but with many developers offering incentives and discounts, I’m keeping an eye on newly constructed homes that are unique and in good areas. I don’t like cookie-cutter developments in the suburbs. It’s too hard to differentiate your property to prospective tenants and can create a race to the bottom in adverse market conditions.

6. Beware of short-term rentals

I think high-priced vacation rental markets are going to get hit the hardest. During the pandemic, demand for second homes skyrocketed alongside interest from short-term rental investors. That demand (not prices) has come crashing back down to earth (I don’t use that word lightly.) I worry that some STR investors bought at a bad time, and if demand falls off during a recession, there could be some forced selling. I never root for anyone to lose their shirt on a home they bought or an investment, but if that does come to pass, it could present buying opportunities.

7. Explore creative financing options

Consider creative financing options, like Subject To (SubTo) and seller financing. These financing strategies offer the opportunity to buy real estate at lower rates than conventional mortgages and can help boost your spending power.

8. Hold on to what you got

If you bought property within the last 10 years with low-interest debt, stay calm and carry on. You may give back some recent appreciation, but if your property cash flows, rent growth is improving your cash flow and might continue to do so into the future—making it a solid long-term investment. It may sound boring, but deciding to hold a property that cashflows, has a low rate, and could see increased income is a good move in this market! The alternatives, such as a cash-out refinance, 1031 exchange, or selling and paying taxes, will likely yield worse returns than just holding on.

9. Use cash, if you can

If you have the means, consider buying with all cash. We all know debt is expensive. If you believe the consensus that price growth is likely to come in between 3% and -8% next year, then investing in real estate using high-interest rate debt may actually be dilutive to your returns compared with buying in all cash in the near term. If you buy a property generating income at a 4% cap rate, and assume 2% appreciation next year, then 6-7% interest rate debt will likely make your returns worse than if you buy all cash. Don’t believe me?

Try it out on the BiggerPockets Rental Property Calculator for yourself. Depending on your appreciation assumption, financing with debt may actually make your returns worse than buying all cash. Not many people have this option, but if you do, it’s worth exploring.

10. Become a private lender

As rates continue to rise, it could be a great time to shift at least part of your real estate strategy to the lending side. Returns on private lending can be as high as 10-14% in the current market, and demand for private loans is likely to rise significantly in the coming months. Your worst-case scenario as a lender is that you become an equity holder in the real estate property you are lending to. If researched and executed carefully, lending may produce much higher returns than equity investments over the next 12 months, with a dramatically lower risk profile.

11. Time the market if you have a crystal ball

Lastly, you could try to time the market, but that is notoriously difficult and something I would not try to do. Instead, I stick to the basics and look for good long-term opportunities. Remember, property values are not the only way you make money with rental property investing. You could try to time the market, but in the meantime, you’ll miss out on cash flow, loan pay down, and tax benefits.

I’m not saying you should buy just anything, but you need to factor in variables other than property prices when deciding where to allocate your capital. If you want to learn how to analyze deals with all of these metrics, you can check out my new book, Real Estate By The Numbers, which I co-authored with BiggerPockets legend, J Scott.

Conclusion

This advice is all based upon my current read of the market, so you may want to consider alternative strategies if you think my read is incorrect. With all the economic uncertainty right now, it’s really difficult to know what will happen next, but I hope this analysis helps you interpret what is going on and how to invest in the current market. I’d love to hear your take in the comment section below.

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.