Using the POWR Options approach to increase returns at lower risk in iron ore mining mammoth Rio Tinto (RIO).

Option trading can be befuddling to many. No doubt that some of the intricate strategies used by hedge funds and big banks can be both complex and daunting.

Luckily, there are simpler and more straightforward ways to trade options that the average retail investor can use to both lower the risk and upfront cost and increase potential returns.

These are exactly the type of trades we employ in the POWR Options program. We combine the POWR Ratings along with technical and volatility analysis to select the best stocks to buy bullish calls along with finding the worst stocks to buy bearish puts.

A walk through the latest closed out trade in RIO will help shed some light on the process.

For those unfamiliar with Rio Tinto (RIO) stock, it is the world’s second largest mining company. The primary focus is on iron ore.

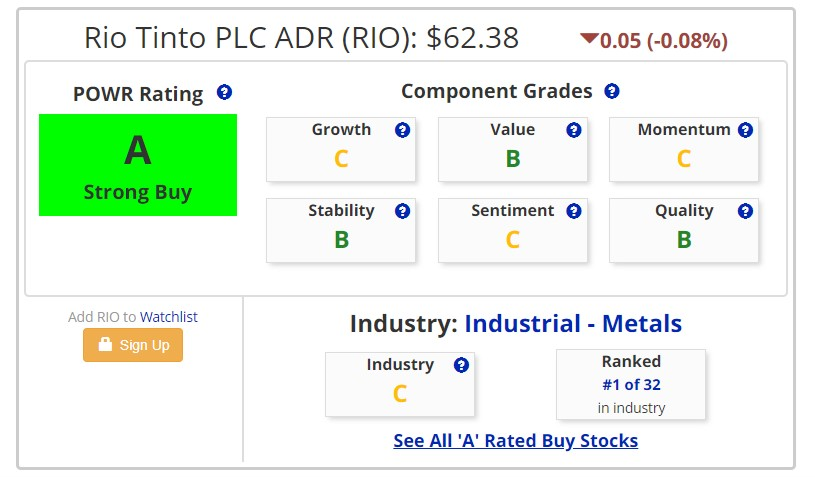

POWR Rating

Rio Tinto was a Strong Buy (A-Rated) stock in the POWR Ratings. Three Buy Component Grades. Ranked at the very top at number 1 in the Industrial Metals Industry. Best steel stock to buy.

Technicals

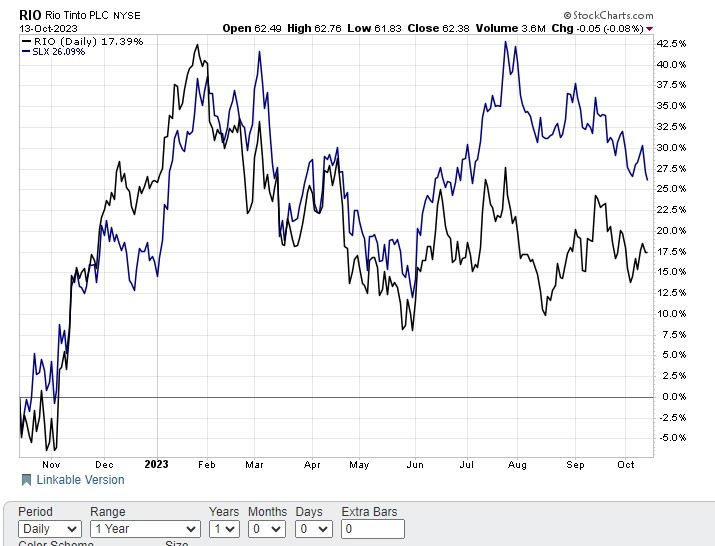

RIO had bounced once again of major support at the $60 level after nearing oversold readings once again. Shares were poised to break past the 20-day moving average and MACD was on the verge of generating a fresh new buy signal.

RIO Stock was also trading at a big discount to the Steel Index (SLX). Normally the two are highly correlated as seen in the comparative chart below. This makes sense given RIO is the largest component of the Steel Index at 13% weighting.

Implied Volatility (IV)

Implied volatility (IV) was also trading below average at the 38th percentile. This means option prices were comparatively cheap. Even more so given that the VIX at the time of trade inception on October 16 was trading near the highest levels of the year.

This set up the trade recommendation to buy the RIO January $61.88 calls at $5.10 w.10 discretion.

Fast forward to November 14 and the technical situation in RIO stock had changed decidedly. Shares were now getting overbought as RIO neared overhead resistance at $68. The comparative differential between SLX and RIO had narrowed significantly. In addition, RIO stock had fallen from A-rated to B-rated. Still a Buy, just not a Strong Buy. Rio Tinto had also fallen to number 6 in the Industry from number 1.

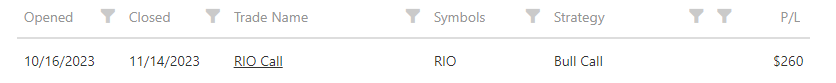

POWR Options issued a close-out of the RIO January $61.88 calls for $7.70 w.10 discretion. This equates to just over a 50% gain in just under a month. Actual results shown below:

While the stock had rallied from $64 to $68 in that month time frame for a gain of 6.25%, the options we bought rose 8 times that amount. Highlights the power of options and POWR Options. Plus, the cost of buying 100 shares of RIO would have been over $6000. The cost of the January call options was right around $500-or only 8% of the cost.

Certainly, not every trade will work out this well or to this degree. After all, trading is all about probability, not certainty. But using the POWR Options approach can help increase the probability of success and put the odds more in your favor.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

shares closed at $450.79 on Friday, up $0.56 (+0.12%). Year-to-date, has gained 19.18%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post How We Were Able To Steal Some Profits In Steel Stock Giant RIO appeared first on StockNews.com