One of the earliest questions organisations need to answer when adopting

data mesh is: “Which data products should we build first, and how do we

identify them?” Questions like “What are the boundaries of data product?”,

“How big or small should it be?”, and “Which domain do they belong to?”

often arise. We’ve seen many organisations get stuck in this phase, engaging

in elaborate design exercises that last for months and involve endless

meetings.

We’ve been practicing a methodical approach to quickly answer these

important design questions, offering just enough details for wider

stakeholders to align on goals and understand the expected high-level

outcome, while granting data product teams the autonomy to work

out the implementation details and jump into action.

What are data products?

Before we begin designing data products, let’s first establish a shared

understanding of what they are and what they aren’t.

Data products are the building blocks

of a data mesh, they serve analytical data, and must exhibit the

eight characteristics outlined by Zhamak in her book

Data Mesh: Delivering Data-Driven Value

at Scale.

Discoverable

Data consumers should be able to easily explore available data

products, locate the ones they need, and determine if they fit their

use case.

Addressable

A data product should offer a unique, permanent address

(e.g., URL, URI) that allows it to be accessed programmatically or manually.

Understandable (Self Describable)

Data consumers should be able to

easily grasp the purpose and usage patterns of the data product by

reviewing its documentation, which should include details such as

its purpose, field-level descriptions, access methods, and, if

applicable, a sample dataset.

Trustworthy

A data product should transparently communicate its service level

objectives (SLOs) and adherence to them (SLIs), ensuring consumers

can

trust

it enough to build their use cases with confidence.

Natively Accessible

A data product should cater to its different user personas through

their preferred modes of access. For example, it might provide a canned

report for managers, an easy SQL-based connection for data science

workbenches, and an API for programmatic access by other backend services.

Interoperable (Composable)

A data product should be seamlessly composable with other data products,

enabling easy linking, such as joining, filtering, and aggregation,

regardless of the team or domain that created it. This requires

supporting standard business keys and supporting standard access

patterns.

Valuable on its own

A data product should represent a cohesive information concept

within its domain and provide value independently, without needing

joins with other data products to be useful.

Secure

A data product must implement robust access controls to ensure that

only authorized users or systems have access, whether programmatic or manual.

Encryption should be employed where appropriate, and all relevant

domain-specific regulations must be strictly followed.

Simply put, it’s a

self-contained, deployable, and valuable way to work with data. The

concept applies the proven mindset and methodologies of software product

development to the data space.

Data products package structured, semi-structured or unstructured

analytical data for effective consumption and data driven decision making,

keeping in mind specific user groups and their consumption pattern for

these analytical data

In modern software development, we decompose software systems into

easily composable units, ensuring they are discoverable, maintainable, and

have committed service level objectives (SLOs).

Similarly, a data product

is the smallest valuable unit of analytical data, sourced from data

streams, operational systems, or other external sources and also other

data products, packaged specifically in a way to deliver meaningful

business value. It includes all the necessary machinery to efficiently

achieve its stated goal using automation.

Data products package structured, semi-structured or unstructured

analytical data for effective consumption and data driven decision making,

keeping in mind specific user groups and their consumption pattern for

these analytical data.

What they are not

I believe a good definition not only specifies what something is, but

also clarifies what it isn’t.

Since data products are the foundational building blocks of your

data mesh, a narrower and more specific definition makes them more

valuable to your organization. A well-defined scope simplifies the

creation of reusable blueprints and facilitates the development of

“paved paths” for building and managing data products efficiently.

Conflating data product with too many different concepts not only creates

confusion among teams but also makes it significantly harder to develop

reusable blueprints.

With data products, we apply many

effective software engineering practices to analytical data to address

common ownership and quality issues. These issues, however, aren’t limited

to analytical data—they exist across software engineering. There’s often a

tendency to tackle all ownership and quality problems in the enterprise by

riding on the coattails of data mesh and data products. While the

intentions are good, we’ve found that this approach can undermine broader

data mesh transformation efforts by diluting the language and focus.

One of the most prevalent misunderstandings is conflating data

products with data-driven applications. Data products are natively

designed for programmatic access and composability, whereas

data-driven applications are primarily intended for human interaction

and are not inherently composable.

Here are some common misrepresentations that I’ve observed and the

reasoning behind it :

| Name | Reasons | Missing Characteristic |

|---|---|---|

| Data warehouse | Too large to be an independent composable unit. |

|

| PDF report | Not meant for programmatic access. |

|

| Dashboard | Not meant for programmatic access. While a data product can have a dashboard as one of its outputs or dashboards can be created by consuming one or more data products, a dashboard on its own do not qualify as a data product. |

|

| Table in a warehouse | Without proper metadata or documentation is not a data product. |

|

| Kafka topic | They are typically not meant for analytics. This is reflected in their storage structure — Kafka stores data as a sequence of messages in topics, unlike the column-based storage commonly used in data analytics for efficient filtering and aggregation. They can serve as sources or input ports for data products. |

Working backwards from a use case

Working backwards from the end goal is a core principle of software

development,

and we’ve found it to be highly effective

in modelling data products as well. This approach forces us to focus on

end users and systems, considering how they prefer to consume data

products (through natively accessible output ports). It provides the data

product team with a clear objective to work towards, while also

introducing constraints that prevent over-design and minimise wasted time

and effort.

It may seem like a minor detail, but we can’t stress this enough:

there’s a common tendency to start with the data sources and define data

products. Without the constraints of a tangible use case, you won’t know

when your design is good enough to move forward with implementation, which

often leads to analysis paralysis and lots of wasted effort.

How to do it?

The setup

This process is typically conducted through a series of short workshops. Participants

should include potential users of the data

product, domain experts, and the team responsible for building and

maintaining it. A white-boarding tool and a dedicated facilitator

are essential to ensure a smooth workflow.

The process

Let’s take a common use case we find in fashion retail.

Use case:

As a customer relationship manager, I need timely reports that

provide insights into our most valuable and least valuable customers.

This will help me take action to retain high-value customers and

improve the experience of low-value customers.

To address this use case, let’s define a data product called

“Customer Lifetime Value” (CLV). This product will assign each

registered customer a score that represents their value to the

business, along with recommendations for the next best action that a

customer relationship manager can take based on the predicted

score.

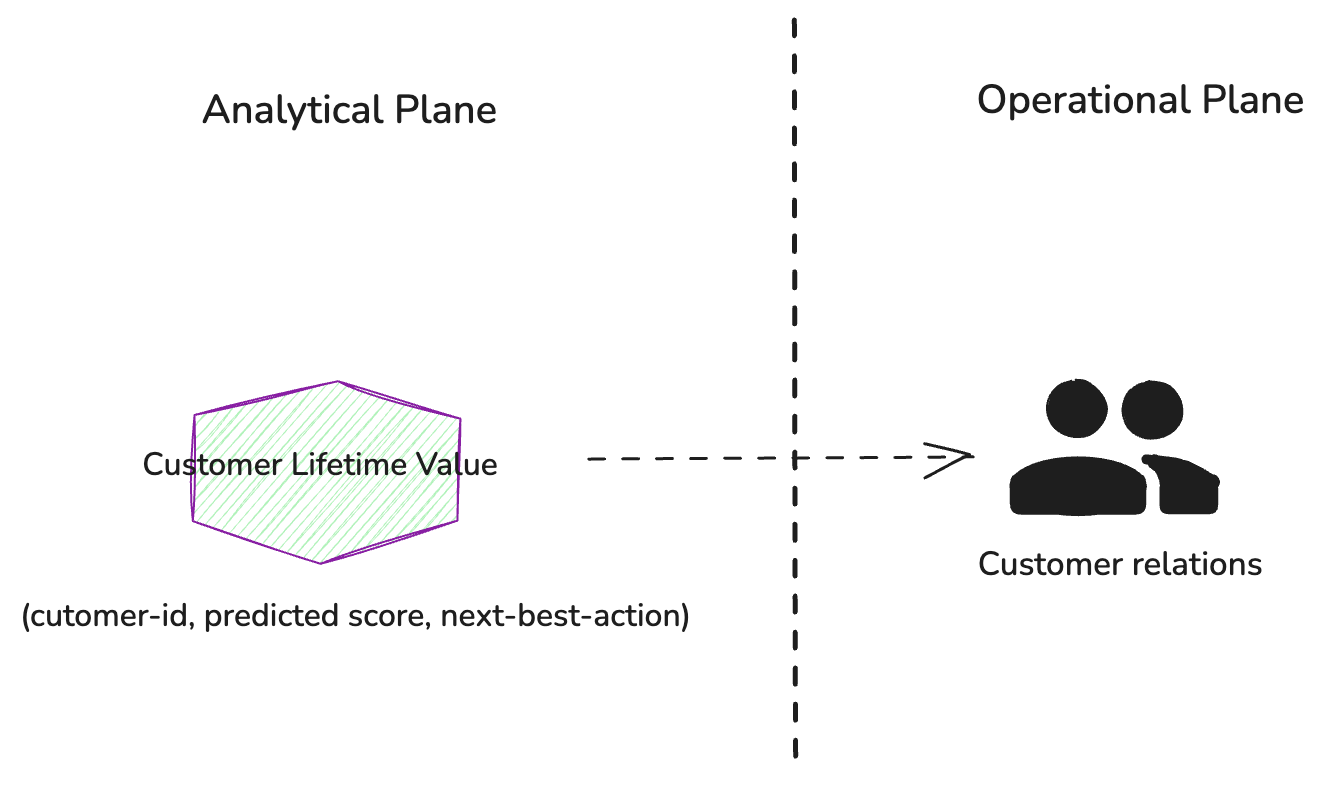

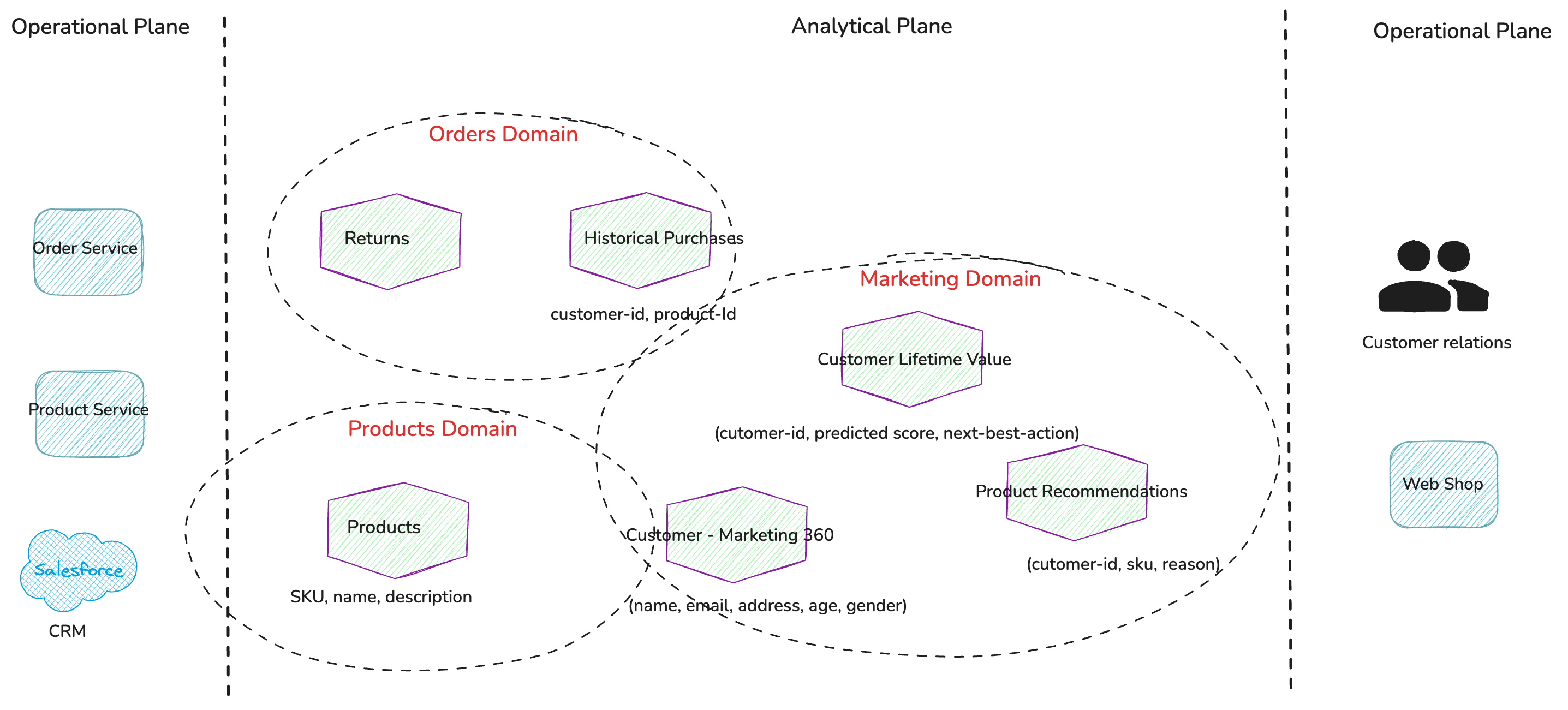

Figure 1: The Customer Relations team

uses the Customer Lifetime Value data product through a weekly

report to guide their engagement strategies with high-value customers.

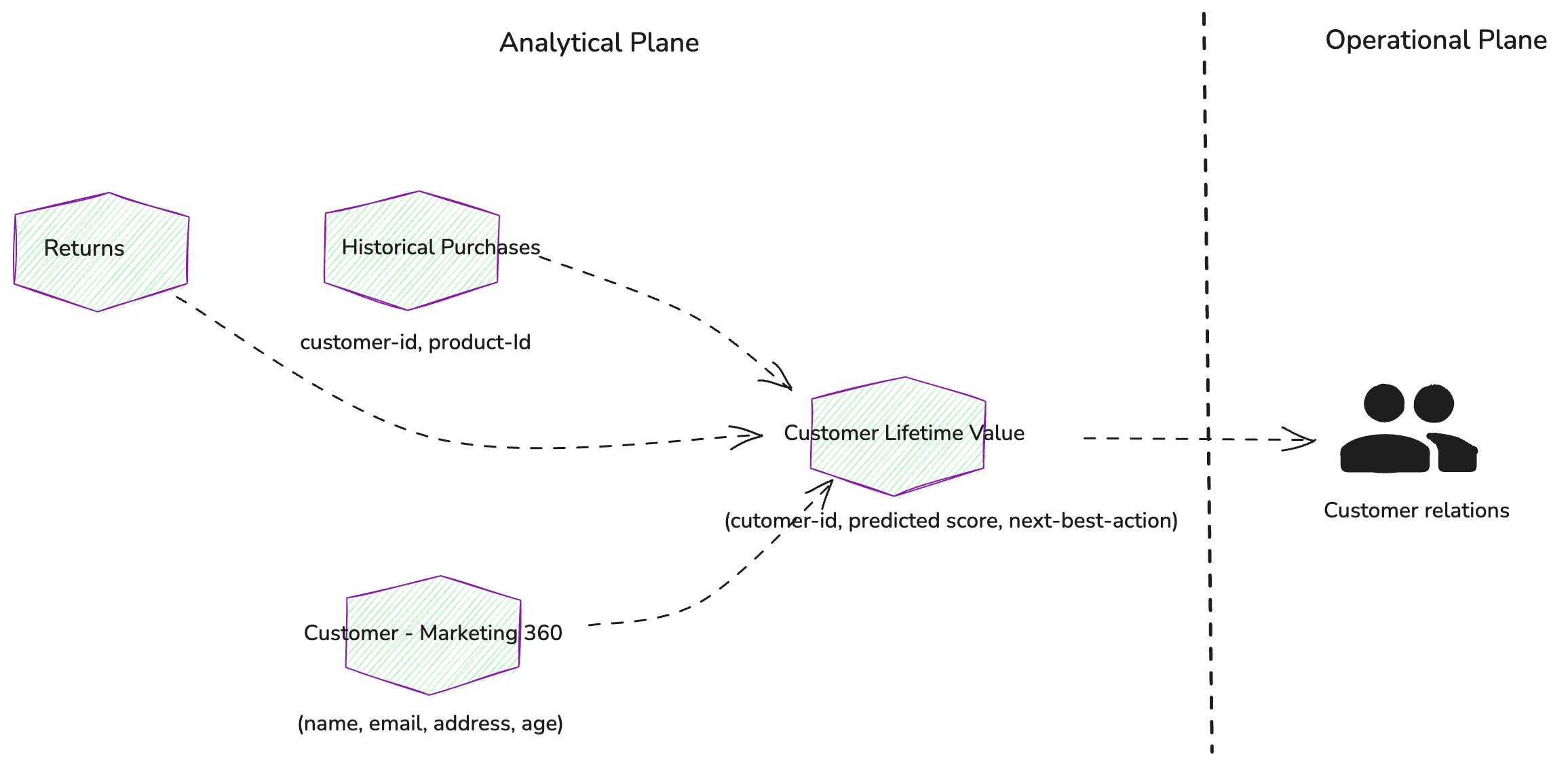

Working backwards from CLV, we should consider what additional

data products are needed to calculate it. These would include a basic

customer profile (name, age, email, etc.) and their purchase

history.

Figure 2: Additional source data

products are required to calculate Customer Lifetime Values

If you find it difficult to describe a data product in one

or two simple sentences, it’s likely not well-defined

The key question we need to ask, where domain expertise is

crucial, is whether each proposed data product represents a cohesive

information concept. Are they valuable on their own? A useful test is

to define a job description for each data product. If you find it

difficult to do so concisely in one or two simple sentences, or if

the description becomes too long, it’s likely not a well-defined data

product.

Let’s apply this test to above data products

Customer Lifetime Value (CLV) :

Delivers a predicted customer lifetime value as a score along

with a suggested next best action for customer representatives.

Customer-marketing 360 :

Offers a comprehensive view of the

customer from a marketing perspective.

Historical Purchases:

Provides a list of historical purchases

(SKUs) for each customer.

Returns :

List of customer-initiated returns.

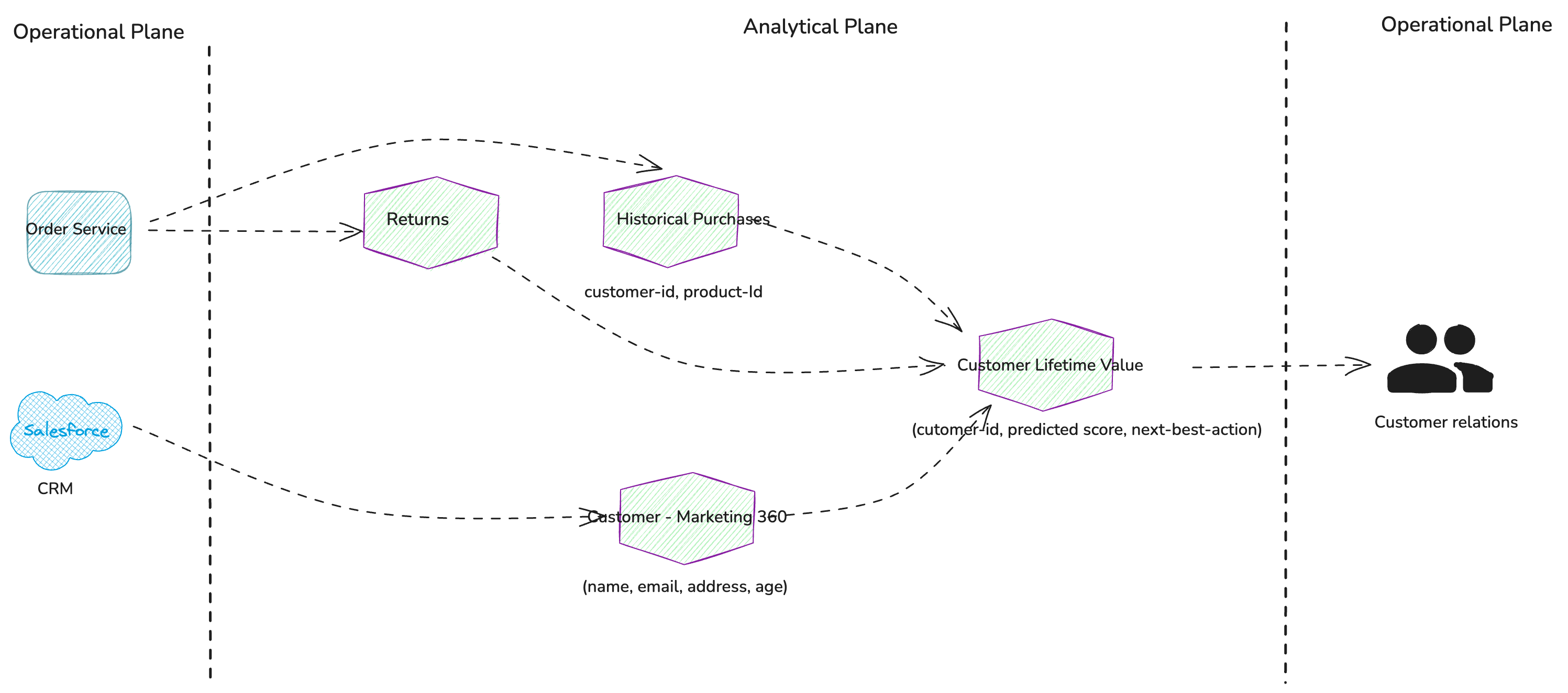

By working backwards from the “Customer – Marketing 360”,

“Historical Purchases”, and “Returns” data

products, we should identify the system

of records for this data. This will lead us to the relevant

transactional systems that we need to integrate with in order to

ingest the necessary data.

Figure 3: System of records

or transactional systems that expose source data products

Overlay additional use cases and generalise

Now, let’s explore another use case that can be addressed using the

same data products. We’ll apply the same method of working backwards, but

this time we’ll first attempt to generalise the existing data products

to fit the new use case. If that approach isn’t sufficient, we’ll then

consider developing new data products. This way we’ll ensure that we are

not overfitting our data products just one specific use case and they are

mostly reusable.

Use case:

As the marketing backend team, we need to identify high-probability

recommendations for upselling or cross-selling to our customers. This

will enable us to drive increased revenue..

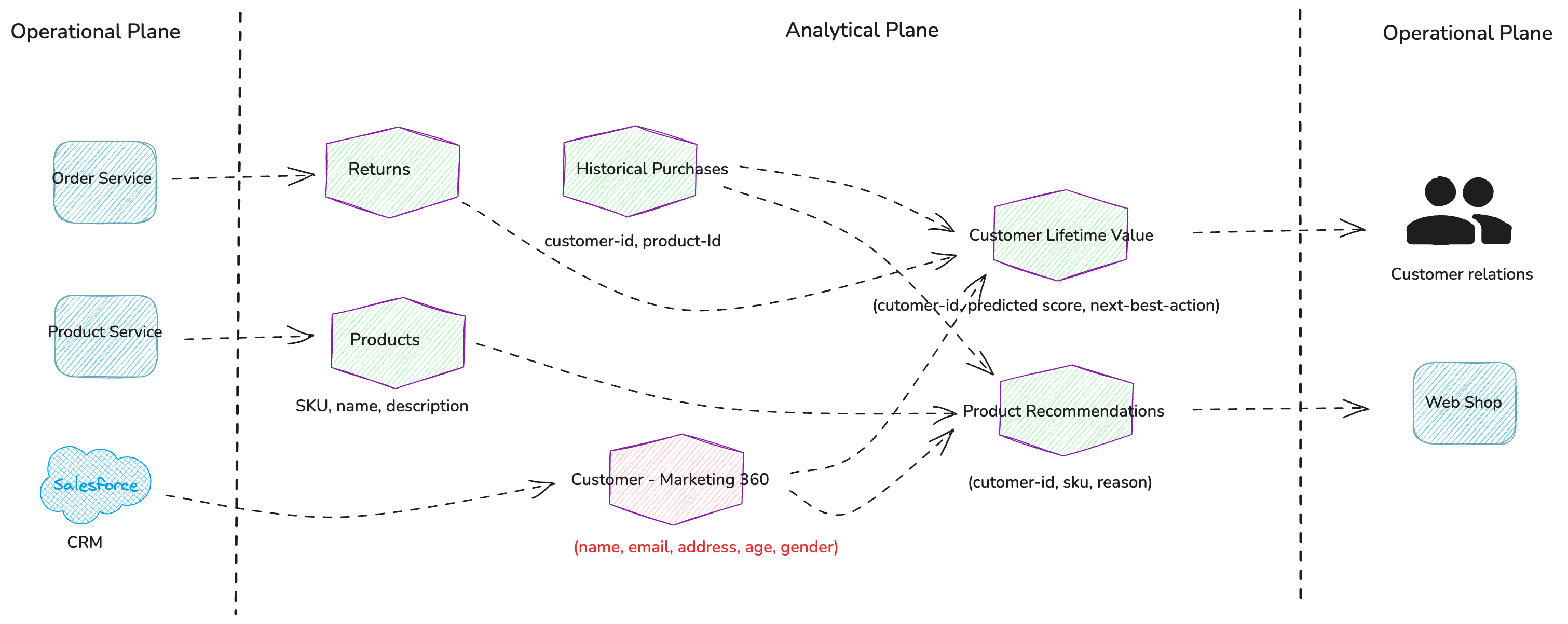

To address this use case, let’s create a data product called

“Product Recommendations” which will generate a list of suggested

products for each customer based on their purchase history.

While we can reuse most of the existing data products, we’ll need to

introduce a new data product called “Products” containing details about

all the items we sell. Additionally, we need to expand the

“Customer-Marketing 360” data product to include gender

information.

Figure 4: Overlaying Product

Recommendations use case while generalizing existing

data products

So far, we’ve been incrementally building a portfolio (interaction map) of

data products to address two use cases. We recommend continuing this exercise up

to five use cases; beyond that, the marginal value decreases, as most of the

essential data products within a given domain should be mapped out by then.

Assigning domain ownership

After identifying the data products, the next step is to determine the

Bounded Context or

domains they logically belong to.

No

single data product should be owned by multiple domains, as this can

lead to confusion and finger-pointing over quality issues.

This is done by consulting domain experts and discussing each data

product in detail. Key factors include who owns the source systems that

contribute to the data product, which domain has the greatest need for it,

and who is best positioned to build and manage it. In most cases, if the

data product is well defined and cohesive, i.e. “valuable on its own”, the

ownership will be clear. When there are multiple contenders, it’s more

important to assign a single owner and move forward—usually, this should

be the domain with the most pressing need. A key principle is that no

single data product should be owned by multiple domains, as this can

lead to confusion and finger-pointing over quality issues.

Figure 5: Mapping data products to their

respective domains.

The process of identifying the set of domains in

your organization is beyond the scope of this article. For that, I

recommend referring to Eric Evans’ canonical book on Domain-Driven Design and the Event Storming technique.

While it’s important to consider domain ownership early, it’s

often more efficient to have a single team develop all the necessary data

products to realise the use case at the start of your data mesh journey.

Splitting the work among multiple teams too early can increase

coordination overhead, which is best delayed. Our recommendation is to

begin with a small, cohesive team that handles all data products for the

use case. As you progress, use “team cognitive

load” as a guide for when to split into specific domain teams.

Having a consistent blueprints for all data products will make this

transition of ownership easier when the time comes. The new team can

focus solely on the business logic encapsulated within the data

products, while the organization-wide knowledge of how data products are

built and operated is carried forward.

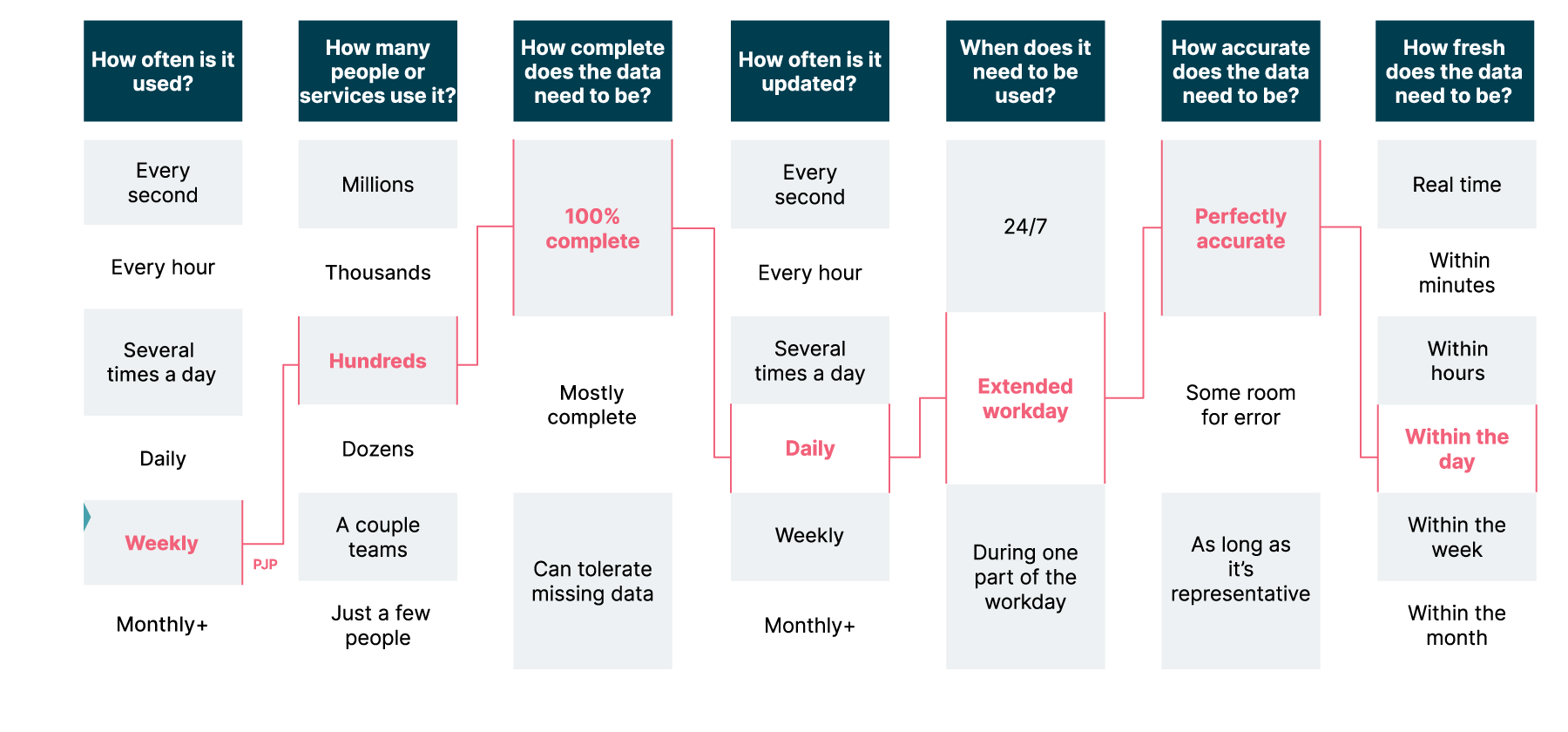

Defining service level objectives (SLOs)

SLOs will guide the architecture, solution

design and implementation of the data product

The next step is to define service level objectives (SLOs) for the

identified data products. This process involves asking several key

questions, outlined below. It is crucial to perform this exercise,

particularly for consumer-oriented data products, as the desired SLOs for

source-oriented products can often be inferred from these. The defined

SLOs will guide the architecture, solution design and implementation of

the data product, such as whether to implement a batch or real-time

processing pipeline, and will also shape the initial platform capabilities

needed to support it

Figure 6: Guiding questions to help define

Service level objectives for data products

During implementation, measurable Service Level Indicators (SLIs) are

derived from the defined SLOs, and platform capabilities are utilized to

automatically measure and publish the results to a central dashboard or a

catalog. This approach enhances transparency for data product consumers

and helps build trust. Here are some excellent resources on how to

achieve this:

A step-by-step guide and

Building An “Amazon.com” For Your Data Products.