The Federal Reserve just increased interest rates another .75% in one of the fastest course corrections in the history of monetary policy. Many are now predicting doom for the real estate market. And while real estate will almost certainly go down (indeed, that seems to be intentional), the strong lending standards of late, low-interest, fixed-rate debt most homeowners have, and the persistent housing shortage should prevent another housing crisis.

But the saying amongst military strategists that “generals always fight the last war” could just as well apply to economists; “economists always predict the last recession.” (That is when they’re not predicting seven of the last two recessions, but that’s another topic.)

Housing will likely suffer, and the market will “freeze,” as I will discuss further below. But the real dangers to the world and the American economy lie elsewhere.

Indeed, the “technical recession” of Q1 and Q2 this year, where growth dipped but unemployment stayed below 4%, is not going to be enough to quell inflation. And Federal Reserve chairman Jerome Powell seems (surprisingly from what I predicted) quite dedicated to “be sufficiently restrictive to return inflation to 2%,” which will almost certainly push the United States into a not-so-technical recession.

But it’s important to remember that most recessions are far from catastrophic. People think of the 1950s as an economic boom time, yet it had three separate recessions. Even the deep recession in 1982 caused by Chairman Volker sharply increasing interest rates to quell inflation was relatively short-lived. There are, however, ominous clouds circling in areas outside of real estate and the United States in general that should be monitored carefully as they could conceivably cause a global financial contagion.

And the first place to look is Europe, most notably Germany.

The European Energy Crisis

Most of Europe has found itself in a severe energy crisis, with Germany being hit the hardest. When Russia invaded Ukraine, the United States and other European nations put a litany of sanctions on Russia. Russia responded by cutting off natural gas, particularly to Germany. Energy prices spiked and pressure mounted in Germany to reopen Nord Stream 2. However, such possibilities came to an abrupt end when the pipeline was sabotaged in late September.

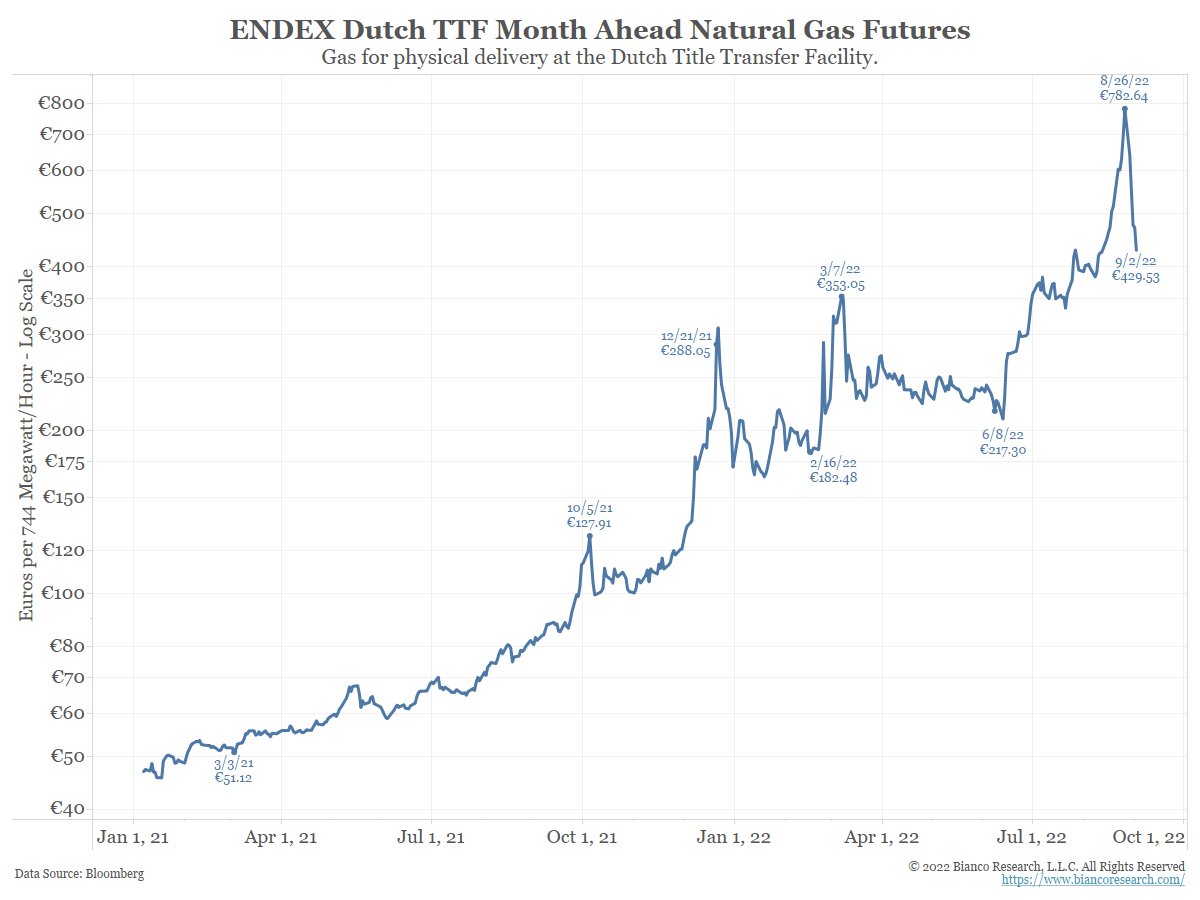

Indeed, in September, the situation looked absolutely dire. Just look at this graph showing an almost ten-fold increase in the price of natural gas futures over the previous year.

European leaders have scrambled to find alternatives and shipped in an enormous amount of natural gas from abroad. Indeed, they have shipped in so much that the situation has (sort of) reversed itself, and spot values have fallen below zero.

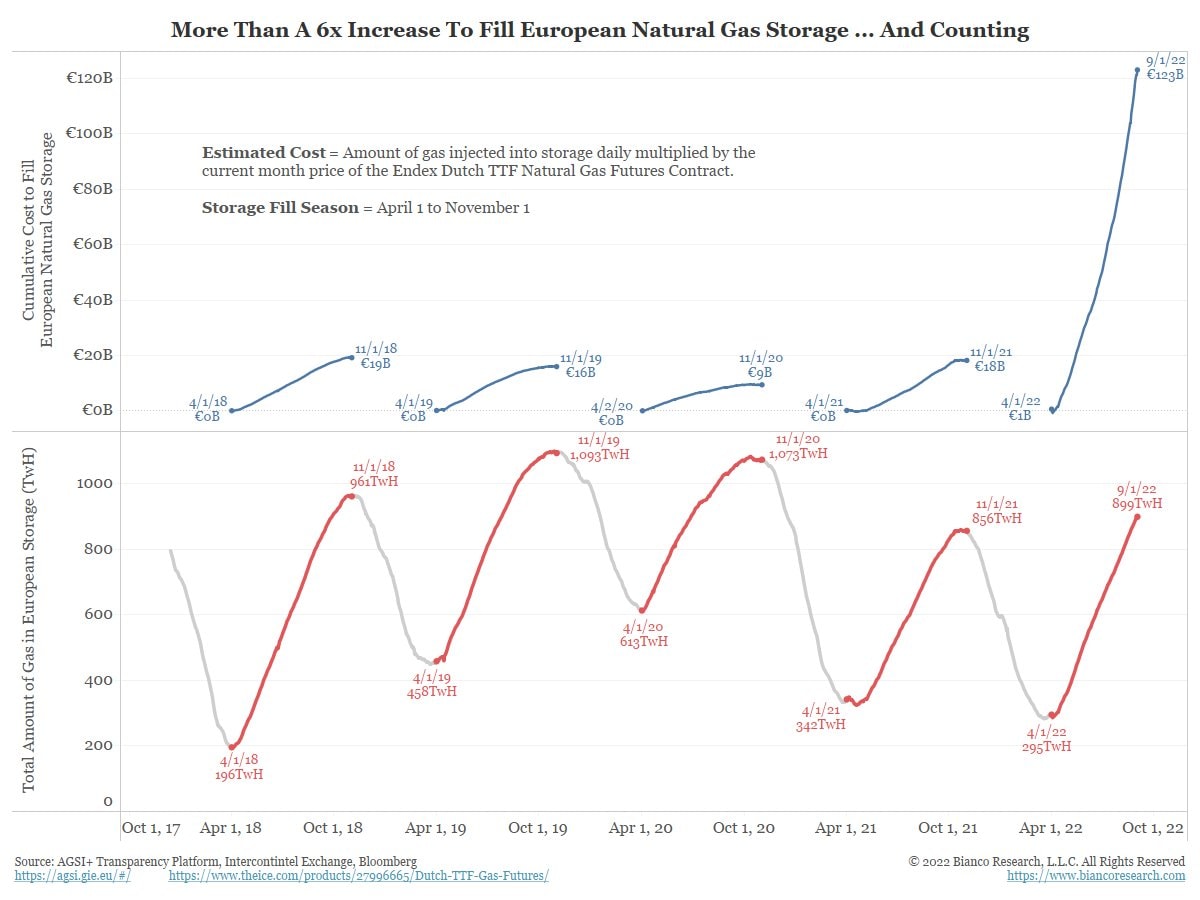

Unfortunately, this most certainly does not mean that the problem is solved. Germany, and all of Europe for that matter, has enough gas to get through the winter as of now. The problem is how much they have had to pay for it.

As CNN notes, despite being blessed with “unseasonably mild weather” with “consumption closer to August and early September [levels],” natural gas futures “are still 126% above where they were last October.”

Indeed, to fill European gas storage to capacity, it cost 6.5 times as much this year than in previous years.

The crisis is hitting most of Europe. The U.K. government, for example, estimates 10,000 Brits will die this winter due to energy expenses making them unable to sufficiently heat their homes. But again, the country in the worst shape of them all is Germany, which was especially vulnerable as 55% of its natural gas had come from Russia before the war began. Spiegel International puts the crisis into context,

“The current gas crisis has all the ‘ingredients for this to be the energy industry’s Lehman Brothers,’ Finnish Economic Affairs Minister Mike Lintilä said recently. Back in 2008, investment banks triggered a global financial and economic crisis by selling toxic home mortgages tied up in wild securities constructs. This time, it is high gas and electricity prices that could trigger a systemic collapse…

“Many companies are unlikely to survive. In August alone, the number of insolvencies among corporations and partnerships, mostly medium-sized firms, grew by a quarter year-on-year. For October, Steffen Müller of the Leibniz Institute for Economic Research in Halle predicts an increase of one-third compared to 2021. And this doesn’t even take into account the increased energy costs and inflation. Müller expects a structural change in the German economy. Due to the long-term cost increases in energy, wages, intermediate products, and interest rates on loans, ‘some business models are just no longer sustainable.’ Müller says that weak companies ‘are now getting flushed out of the market.’”

The measures being taken to address this crisis have ranged from the obvious (extending the operations of nuclear power plants that were scheduled to go offline) to extreme (cutting down ancient forests for wood to burn as fuel). And, of course, Germany intends to subsidize electric bills while mandating less energy use amongst its citizens and businesses.

Government forecasts for growth have been reduced by almost 3% and now expect Germany to fall into a recession in 2023 while inflation stays near 10%. At the same time, for Europe on the whole, energy bills could be three times higher than last year.

And, of course, it could be substantially worse. There were, after all, many overly optimistic predictions about a short recession at the beginning of the housing crisis in 2008.

A Global Contagion?

Europe is going to go through a lot of pain this winter. And while our thoughts and prayers should be with them, the immediate question is simply whether this will be Europe’s problem or, as Mike Lintilä analogized, “the energy industry’s Lehman Brothers.” We should remember that what was predominantly (but not only) an American housing collapse in 2008 unleashed a worldwide recession that was by no means restrained by the borders of the United States.

Markets are global, and shortly after the energy crisis started, the United States started sending the bulk of its export gas to Europe. While this made perfect sense, it also depleted domestic stockpiles and has caused prices here to rise.

While nowhere near as acute as Europe, across the board, we’re seeing energy shortages. For example, in New York and New England, heating oil is at one-third of its normal levels, and rationing has already begun.

The United States also depleted half of its strategic oil reserve to combat higher gas prices earlier this year. In an attempt to alleviate global shortages, the Biden Administration asked (begged?) Saudi Arabia to increase oil production. Instead, Saudi Arabia cut oil production by 2 million barrels per day. Unfortunately, it turns out that relying on a medieval, theocratic oil company isn’t a particularly reliable strategy.

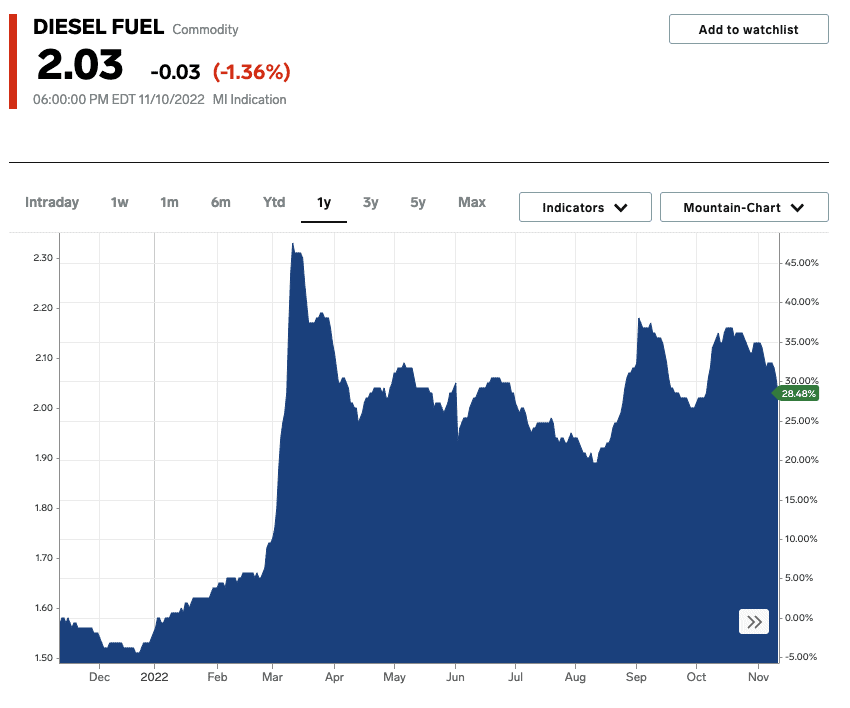

In particular, though, diesel fuel is in short supply. As of October 25, the U.S. was down to just a 25-day supply. As New Your Magazine put it, “The last time there was this little supply, there were about 3.5 billion fewer people on the planet.”

Of course, the United States will almost certainly not run out of diesel. What will happen instead is that prices will rise to both ration supplies and incentivize imports and production.

The problem is that, well, prices will rise. In fact, prices have already doubled this year and will likely increase further.

Energy prices are a major driver of inflation, and, as we have seen, central banks are cranking up interest rates to slow general price increases. Even still, Germany is expected to have significant stagflation next year with near 10% inflation during an expected recession (and perhaps, a deep recession). And if many factories and businesses go under from excess energy costs, it could cause permanent damage to the German economy that will prevent anything even resembling a “V-shaped” recovery.

It should also be noted there are other global areas of concern. The war in Ukraine could potentially escalate. China’s sovereign debt situation is teetering on the brink of becoming a crisis. Volatility and risk is high right now, to say the least.

Given this situation, it is unlikely that inflation will be quickly stymied, which will require central banks to maintain high rates at least through much of 2023. An all-out collapse isn’t probable, in my judgment. But at this point, recessions throughout much of the world—particularly Europe and probably the United States—seem to be all but a given right now.

Of course, if we do fall into a deep recession, pressure will build for central banks to ease up, and, at that point, it’s anyone’s guess whether they will cave. Earlier this year, I would have said they absolutely would lower rates if we went into a non-technical recession (one with high unemployment), but their recent aggressiveness has given me second thoughts.

How Will This Affect the Domestic Real Estate Market?

A somewhat odd headline recently ran in Fortune starting with “Housing market activity is crashing.” Notice it’s “activity” that’s crashing more so than the market.

It notes that, for example, “mortgage purchase applications are down 38% on a year-over-year basis.” It’s clearly not a good time to be a real estate agent or a mortgage broker.

And with the increase in rates and global energy crisis, there’s no reason to see this train slowing down.

The good thing this time around is that lending standards were far better than pre-2008. Now, almost everyone has fixed-rate debt at low rates and substantial equity in their homes. Therefore, instead of a real estate crash like 2008, expect a “real estate freeze,” or, as Bill McBride puts it, a “Sellers Strike.”

New real estate listings are already down close to 15% year-over-year, and given most people don’t need to sell because of the fantastic loans that were available over the last few years, there’s little reason for them to sell.

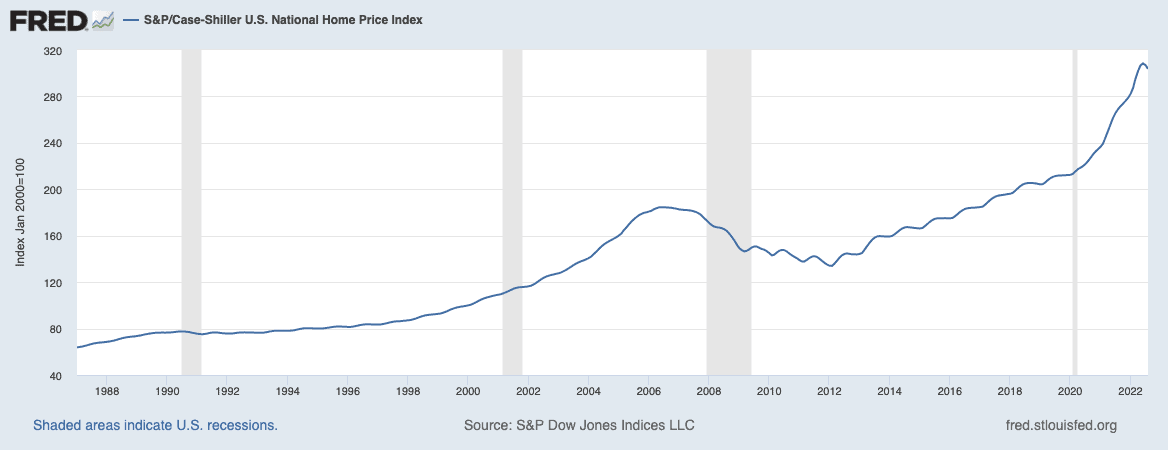

It’s this ability for sellers to “strike” that usually buoys real estate prices during recessions. As you can see, looking through the Case-Shiller Index since its inception in 1987, in four of the last five recessions, real estate prices either didn’t go down or barely did.

Even during the 1982 recession, which saw interest rates in the teens, home prices actually went up 1%. (Although they went down in real terms when adjusted for inflation.) Of course, the 2008 recession was very different. That, however, was because the spiral of defaults and foreclosures from all the bad mortgages lead to a wave of distressed sales.

Goldman Sachs sees home prices falling 5-10% next year. Wells Fargo, for its part, expects the following for 2023:

- New Home Sales down 6.5%

- Existing Home Sales down 13.1%

- Home Prices down 5.5%

I think it will likely be a bit worse, but not by any means catastrophic in terms of prices.

It will be “catastrophic” in terms of activity. Again, it will likely be very tough for real estate agents, wholesalers, and mortgage brokers. Flippers will also have struggles finding buyers and buy and hold investors will have a lot of trouble with financing.

The most likely effect the global energy crisis will have on housing is that it will likely extend this “freeze” for quite some time. Don’t expect rates to be “back to normal” by the middle of next year.

It could possibly lead to a global contagion and financial crisis as well. While not likely in my judgment, with this much uncertainty going into the winter, it would be wise to stay as liquid as possible with as high of cash reserves as possible. If we do go into a deep recession, having excess cash to help with increased delinquency and higher interest rates is essential. It’s also great for buying up cheap assets at fire sale prices.

It would also be wise to be extra conservative on new acquisitions in the coming months, at least until Spring returns. Buying a large project before the bottom falls out is not a particularly lucrative strategy.

Caution and liquidity would be my recommended approach, at least until it’s clear that the energy crisis in Europe (and the rest of the world to a certain extent) only causes a recession and does not become “the energy industry’s Lehman Brothers.”

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.