One of the most frequently asked questions I’ve gotten in the last year has been about how I got into short-term rental investing.

The answer? I started when I was a real estate agent seven years ago. I had helped a couple of clients purchase STRs and was awestruck by the returns they saw. But when I started to look for a property, everything was either way out of my price range, or it simply wouldn’t have done well as an STR.

So, I decided to build a short-term rental. I found a general contractor to build it and a lender to provide a bulk of the financing. I put 10% down on the construction loan, which took about a year to build and furnish.

This property was an 830-square foot A-frame cabin that cost about $225,000 to acquire the land, build, and furnish. My out-of-pocket costs were about $30,000, which included the down payment, closing costs, furnishings, and holding costs. Last year, the A-frame did $80,720 in gross revenue and $52,000 in net. For my numbers nerds out there, that is an annual cash-on-cash return of 173%.

Granted, this property was built before 2020, but even after material and labor costs increase, the property will still get close to a 100% ROI every year.

So why am I sharing this? I truly believe that unique properties in the right location are practically recession-proof. My properties have been through the lockdowns and the current economic instability we’re facing. Yet my calendars have been fully booked up at a 95% occupancy.

Why Unique Properties Will Continue to Dominate

Let’s first start by defining what a unique property is? A unique property is where the short-term rental is an “experience” outside the city a guest is visiting.

I like to call them “Instagramable” properties. Examples of unique properties are A-frames, log cabins, treehouses, tiny houses, and themed glamping sits. There are thousands of different ideas that people have come up with for unique short-term rentals. Simply hop onto Airbnb and you can see some pretty crazy STRs that you can rent throughout the world.

Examples of Unique Properties

Four years ago, I started saying on podcasts and to other short-term rental hosts that hospitality, in general, is going through a transformation. My prediction was that more and more people would want to stay in a one-of-a-kind property that they could share on their social media and have a unique experience with.

Something more than a bland hotel. Something more than a normal-looking single-family house. I can honestly say that the prediction couldn’t be truer four years later. There is a crazy demand for unique stays across all online travel services like Airbnb and VRBO. So much so that Airbnb recently redid their whole website and algorithm to highlight unique properties.

If the biggest player in the STR world is completely redesigning their company around unique properties, then I believe it’s something that we should be taking note of.

On top of the changes to their website, Airbnb recently announced a competition with cash prizes of up to $100,000 per project. The whole premise of the competition is to find unique property ideas submitted to them by hosts. If they like your project, they will pay up to $100,000 to get it off the ground so it can be rented on Airbnb. They’re calling it The OMG! Fund.

National Parks and National Forests

The second thing that I believe plays a huge role in an STR being recession-proof is location. Before you roll your eyes, this goes beyond the old real estate adage of “location, location, location.” Over the course of 7 years, I have learned that investing in STRs within 45-60 minutes of a national park or forest is a very effective strategy. I first heard of this strategy from fellow BiggerPockets Real Estate Podcast host and YouTuber Rob Abasolo.

Two things make this strategy so powerful.

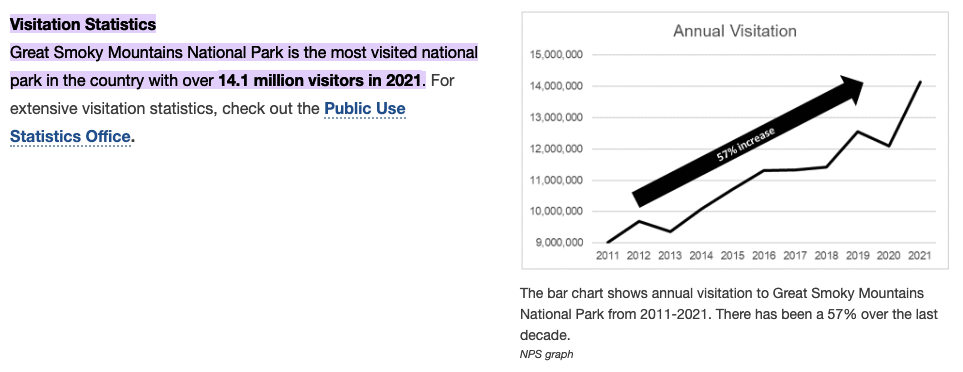

National parks and forests have a built-in “customer” base. Since 2020, national parks and forests have seen record numbers come through, and even with higher gas prices, the demand doesn’t seem to be slowing down. In 2021 alone, the Smokey Mountains saw 14.1 million visitors and over 12.745 million overnight stays. That’s a lot of people.

National parks and forests provide cheap recreational things to do. If you provide unique accommodations in markets like this, I firmly believe that a guest or a family looking for a place to stay will choose your unique property over a hotel or a normal-looking single-family house.

What’s important to consider is what is unique to the area you are looking to invest in. Log cabins tend to do well in the mountains. Modern contemporary homes will do better in desert markets like Joshua Tree, California. On the coast, some hosts rent out their docked boats as STRs on water.

Some markets also tend to be less seasonal than beaches or ski towns. There are high and low seasons in every market, but in a national park or forest market, they tend to be less extreme, which means year-round bookings.

Finally, another favorite part about national park markets is that they tend to be drive-in markets, meaning that people drive into them instead of flying to them. Even when flying to them, they rent cars to get around compared to ride-sharing services.

Some of you might be saying, “But Alex, the gas prices!” and believe me, that’s something I have heard for the past several months. When it comes to recessions, when it comes to market corrections, when it comes to downturns, whatever you want to call them, people don’t stop traveling. They just take shorter trips.

Instead of traveling overseas, maybe they take an extended weekend trip somewhere 2-4 hours away. I currently invest in Western North Carolina markets, and I have seen more guests coming from large metro cities 2-4 hours away from me. Cities like Charlotte, Raleigh, and Atlanta.

Conclusion

In conclusion, two strategies to follow when investing in short-term rentals through this upcoming recession and beyond are to purchase or build unique properties and invest in scenic areas, preferably close to a national park or forest. Take a quick look at the home pages of all the online travel services like Airbnb and VRBO, and you will see a plethora of unique accommodations.

It is what people want and will continue to want. These massive multi-national companies wouldn’t be betting their futures if it wasn’t true. It is also undeniable that there is a need for capital preservation and good deals in these current market conditions. Short-term rentals are one of the most effective real estate classes to help you achieve that. You just have to ensure you are investing using the right principles.

Find long-term wealth with short-term rentals

Vacation rentals can be an extremely lucrative way to boost your monthly income—but only if you acquire and manage your properties correctly. This ultimate guide to analyzing, buying, and managing vacation rental properties will set you up for immediate success and long-term wealth.

Do you want to get involved in short-term rental investing? Register for our STR Bootcamp this fall! Click here to learn more!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.