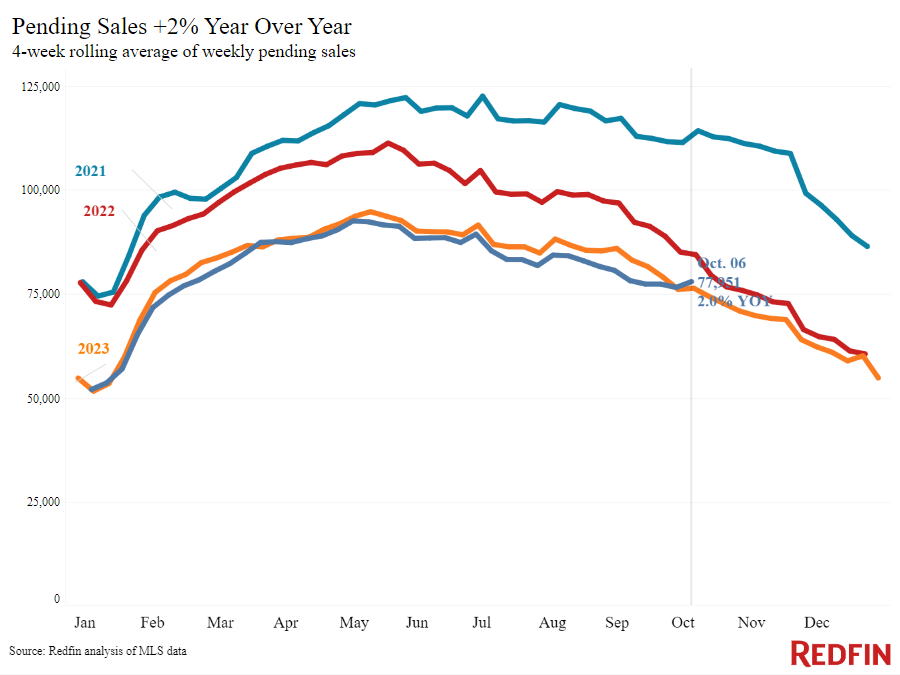

Is the U.S. housing market finally emerging from the pandemic Ice Age-like conditions? There are signs that this may be the case. According to a recent report by Redfin, pending home sales in early October showed the biggest year-over-year increase since 2021, increasing 2% during the four-week period ending Oct. 6.

These numbers will be encouraging to real estate investors who have felt—justifiably—that opportunities have been thin for the past couple of years. Nevertheless, it pays to be thorough and not misinterpret a single metric as a sign of a wider trend.

Can we definitively say that the housing market is returning to its healthy pre-pandemic state at this point? Let’s take a look at the different factors at play.

Interest Rate Cuts: Key Factor or a Red Herring?

Redfin’s report explicitly ties the spike in home sales to the Federal Reserve’s much-anticipated rate cut announcement on Sept. 18. Buyers finally “came out of the woodwork in late September” following the announcement, “even though mortgage rates had already been declining for several weeks in anticipation of the cut,” according to Redfin’s press release about the report.

This ‘‘even though’’ is a significant one. It’s not as if prospective homebuyers were unaware of interest rates declining before the announcement; it does seem that they needed it on a psychological level, though. Partly, this has to do with the fact that it’s hard to let go mentally of the idea of 3% to 4% interest rates enjoyed by buyers pre-2022.

Any announcement of a rate cut has the necessary effect of convincing some people that now is finally a better time to buy a house than, say, a month or so ago. In a volatile mortgage market, official announcements do hold sway.

However, mortgage rates are always only part of the story of how a housing market is performing. Investopedia, for example, identifies it as just one of the four key factors that drive the real estate market. The other three are demographics, the economy, and government policies and subsidies.

We have many examples of demographics driving huge changes within U.S. real estate markets throughout the pandemic era. Huge movements of people, like the much-documented Sunbelt surge, saw real estate in cities like Phoenix and Austin, Texas, boom and then become unaffordable thereafter.

Demographics are about age, too, and without a doubt, pent-up demand among the so-called millennial generation is still the driving force behind the current uptick in home purchases. Millennials longing to buy their first homes and settle down didn’t go anywhere during the past four years—in many cases, there simply weren’t homes there for them to buy.

Inventory Growth Signals Recovery in Several Regions

This brings us to the next major factor that is helping to stabilize the housing market: the steady increase of inventory over the past year. The lack of available homes for sale severely impacted the U.S. housing market since the beginning of the pandemic.

First, sellers weren’t selling because of COVID restrictions. Then it was because the increases in mortgage rates post-2022 made selling seem unpalatable for many.

We’re saying “unpalatable” rather than “unaffordable” for a reason. While some sellers, especially those looking to upsize, would indeed have found themselves in no position to sell and take on a much more expensive mortgage, others simply were in no immediate rush to sell and bided their time for as long as they could.

This is still true, to an extent: According to the latest Realtor.com Housing Market Trends Report, inventory nationwide “is still down 23.2% compared with typical 2017 to 2019 levels.” The “rate-lock hurdle” (sellers put off by high interest rates) “hasn’t disappeared,” says the report.

Still, the trend has been shifting steadily since last year—note that this was the time when interest rates were well above 7%. According to the Redfin report, new listings increased 5.7% year over year in the four weeks ending Oct. 6, but “unlike the increase in pending sales, that’s a continuation of a trend; new listings have been increasing for nearly a year.”

As of September 2024, seven states have actually returned to pre-pandemic inventory levels, according to ResiClub’s analysis of Realtor.com data. Below is the growth of inventory compared to levels in September 2019.

- Tennessee (11%)

- Texas (10%)

- Idaho (10%)

- Florida (9%)

- Colorado (4%)

- Utah (4%)

- Arizona (3%)

Washington very nearly joined this list, missing by just 35 homes.

When people need to sell, they sell; it’s not always a choice. According to Construction Coverage analysis of U.S. Census Bureau’s Building Permit Survey and Population and Housing Unit Estimates data, these are the top states where inventory increased most dramatically since September 2023:

- Florida (59%)

- Georgia (49%)

- North Carolina (48%)

- California (41%)

- Washington (48%)

- Hawaii (62%)

- Arizona (45%)

These areas have been battered by severe weather, from historic forest fires to hurricanes, over the past year. Without a doubt, the surge in home listings in these areas will partly be down to sellers desperate to sell damaged properties they cannot afford to repair due to insurance problems.

The Redfin report narrows in on Florida, explaining that home sales there are down, in contrast with the overall nationwide trend. The data isn’t out yet for North Carolina and other areas hardest hit by Hurricane Helene last month, but a recent survey by Redfin suggests that the devastating storm has made some homebuyers think twice about where they want to live.

This isn’t to say that these are all of a sudden no-go areas for investors. However, like regular homebuyers, investors should give some thought to where they are going regionally. The number of available listings may indicate a recovering housing market—or it can actually indicate a housing market in trouble because of climate change and/or an insurance crisis.

Investing in these areas can be challenging if you don’t have the means to protect your investment from extreme weather. Finding tenants in disaster-prone areas may also become more challenging over time. Although the Redfin survey doesn’t specify whether its respondents are homeowners or renters, it’s not unreasonable to assume that renters (who are disproportionately impacted by natural disasters) may choose “safer” areas in the future.

Investors can really hit the sweet spot right now in areas where inventory is growing for reasons other than people fleeing weather-related trouble. More specifically, you want to be looking for areas that are at least partially solving their long-standing housing crises by building more homes.

According to research conducted by Construction Coverage, using data from the U.S. Census Bureau and Zillow, Idaho, Utah, North Carolina, Texas, and Florida comprise the top five states building the most new homes. Investors will need to do thorough research into specific areas in these states, since some of those that are actively building new homes are also at the highest risk for climate change impact. Places like Idaho and Utah, or Tennessee (which is No. 10 in homebuilding), emerge as attractive current destinations.

The Midwest and Northeast, on the other hand, have quite a long way to go toward recovery. These are the regions where the current rates of inventory growth cannot even begin to bring supply to levels needed for normal market conditions. Existing homes are pretty much all there is in these areas, so investors will continue to find that they are competing for scarce opportunities. Of course, that could all change if new policies are implemented for these and other regions following the upcoming presidential election.

The Bottom Line

The real picture of the U.S. housing market is, as ever, far more intricate and varied than the single statistic of pending home sales increases would suggest. While the market overall is definitely moving in the right direction, it’s doing so at varying paces and with different factors in play in different areas.

Interest rates do play a key part in loosening up the market, but investors should pay close attention to other factors, especially regional challenges around homebuilding, climate change, and home insurance policies.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.