Outside of the roller coaster ride the FTX and Terra coins took, I have rarely seen anything quite like the trajectory nationwide rents have taken over the previous year.

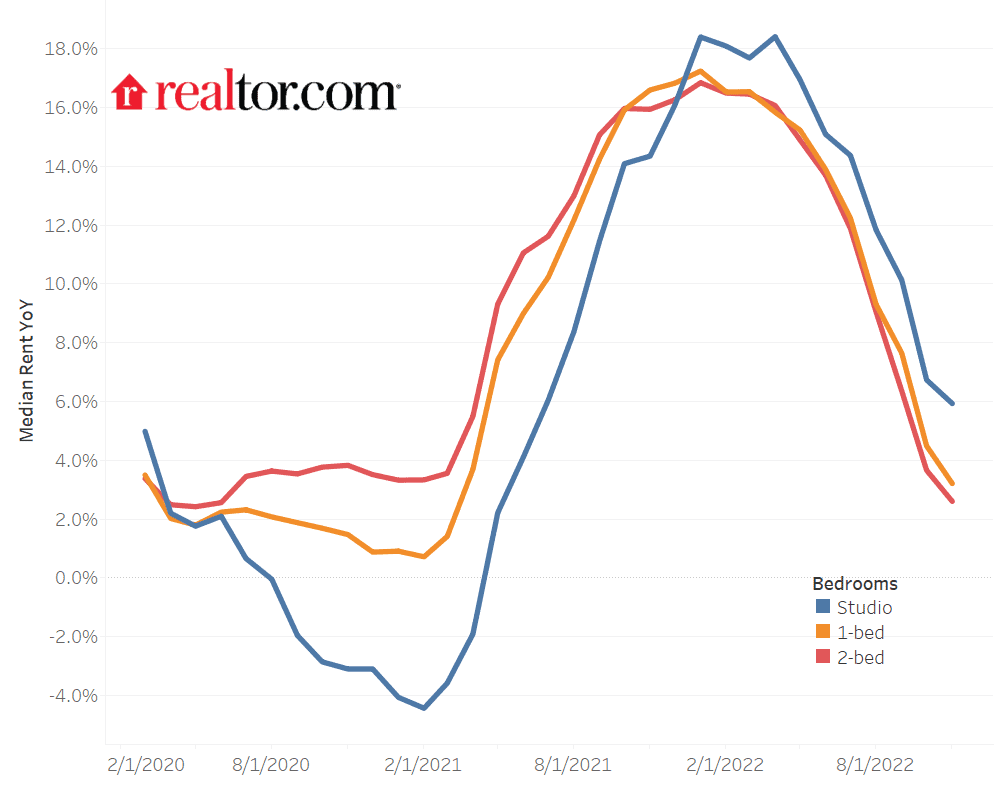

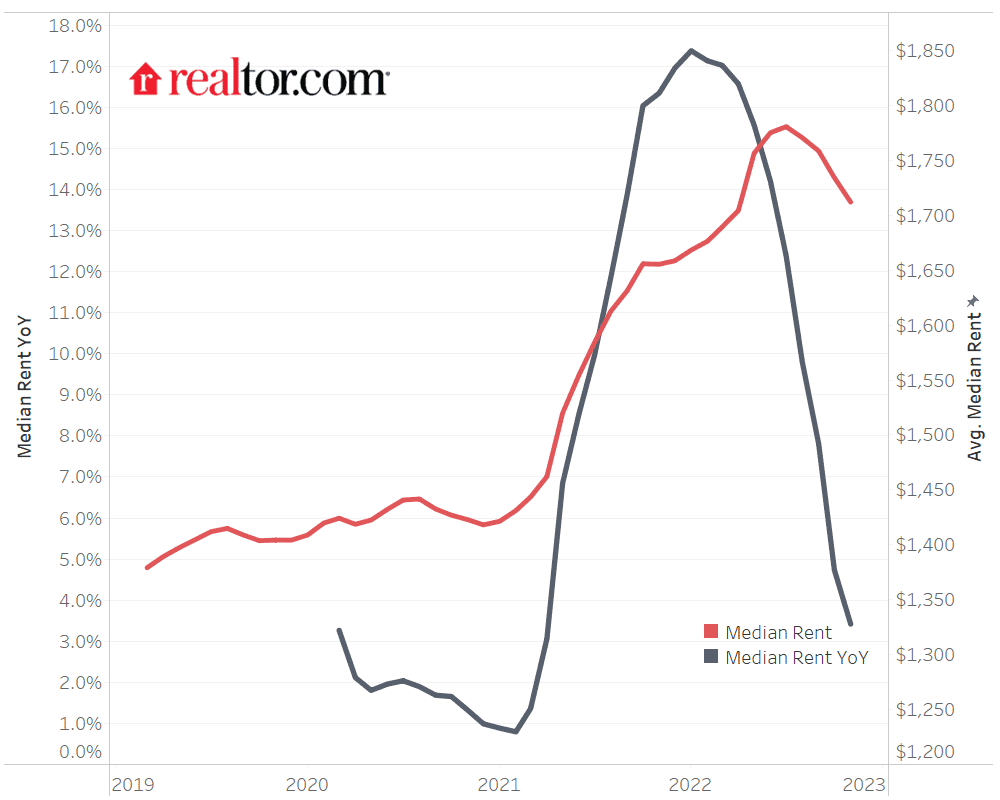

Take a look for yourself.

Of course, this is only showing the year-over-year change and not the rents themselves. Rents are still up year-over-year despite the dramatic about-face that occurred around last March. That being said, we have reached an inflection point where rents have started to decline month-over-month in nominal terms as well.

As Realtor.com notes,

“In November 2022, the U.S. rental market experienced single-digit growth for the fourth month in a row after ten months of slowing from January’s peak 17.4% growth. The median rent growth across the top 50 metros slowed to 3.4% year-over-year for 0-2 bedroom properties, the lowest growth rate in 19 months. The median asking rent was $1,712, down by $22 from last month and $69 from the peak but is still $308 (21.9%) higher than the same time in 2019 (pre-pandemic).” [Emphasis mine]

And if we were to account for inflation, the decline is even sharper.

Furthermore, the “builders strike”, as I call it, “could also put off home shopping plans and further increase rental demand.” The supply side also bodes poorly (or bodes well, depending on your perspective) for future rent prices,

“On the supply side, the number of for-rent properties may gradually increase as homebuilding activity continues to pivot to multi-family properties. This extra supply in multi-family homes could shift market balance, raising the still-low rental vacancy rate and helping temper recent rent growth driven by the excess demand.”

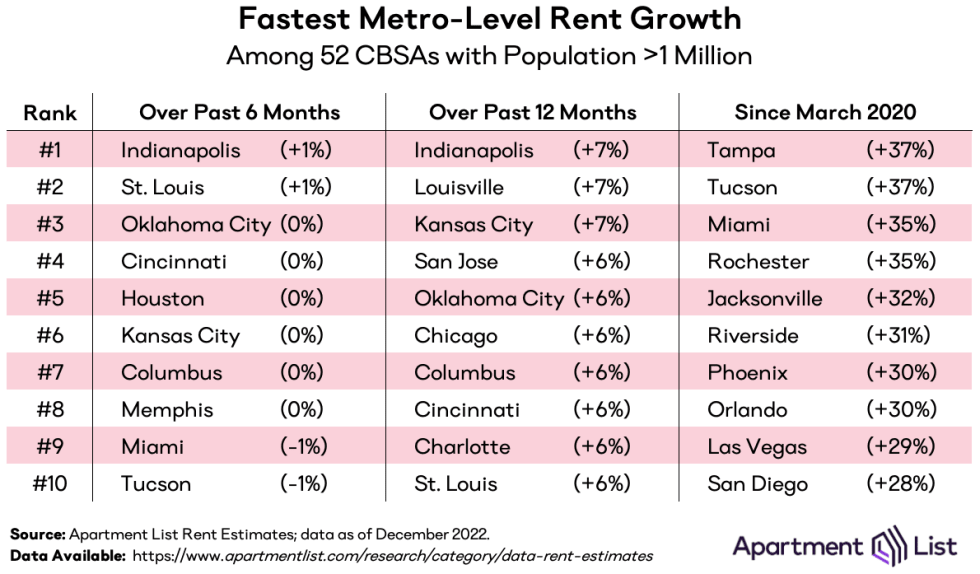

To drive home just how dramatic this shift has been, compare the fastest metro-level rent growth in the top ten cities over the past six months, 12 months, and since the beginning of the pandemic, according to data from ApartmentList. It goes from 37% growth since March of 2020 (Tampa) to 7% in the last 12 months (Indianapolis) to 1% in the last six months (Indianapolis).

When the fastest-growing metro area is at 1% growth, that should tell you everything you need to know.

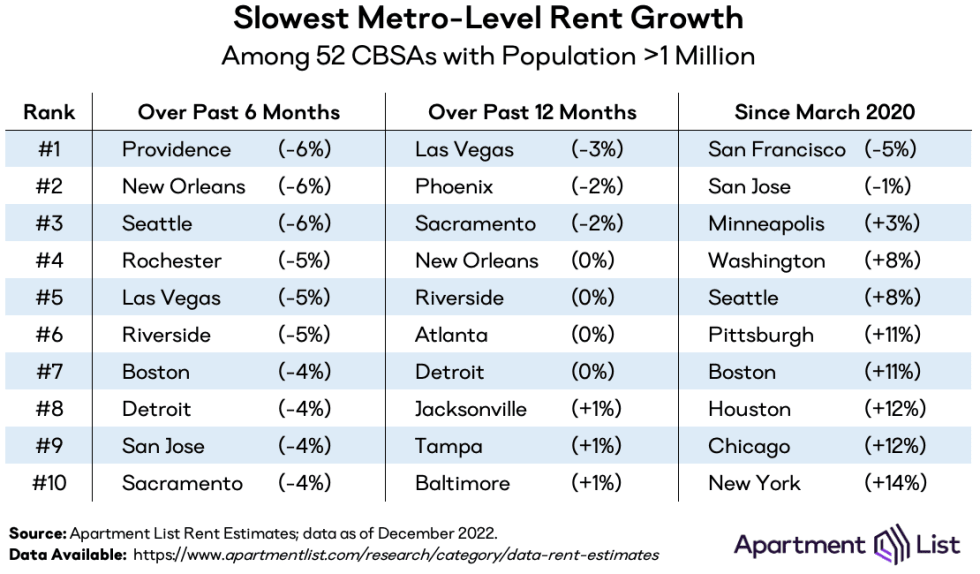

For what it’s worth, the worst-performing market over the past six months was Providence, Rhode Island, at -6%. Since March 2020, the worst has been San Francisco at -5%, but that is mostly due to local factors. In fact, San Francisco is one of only two markets with negative rent growth since March 2020 and one of only five with less than 10% positive rent growth.

Why is This Happening?

One part of this is just seasonality. Prices and rents both tend to dip a bit in the winter. But this is a much larger dip than normal seasonality would predict. There’s much more to the story than just that.

Before the Fed started jacking up interest rates, real estate prices were skyrocketing due to a variety of factors, most notably historically low interest rates and the large, country-wide housing shortage that came from a decade of insufficient housing construction. That shortfall in supply was then further exacerbated by Covid and lockdown-induced delays.

The housing shortage had the same effect on the rental market as it did on the sales market. However, when rates went up, the “sellers strike” began, and new listings fell dramatically. Remember, unlike in 2008, most homeowners today have 30-year fixed loans with low interest rates. There is little incentive to sell.

So one of the first pieces of advice I gave given this new and very odd market was, “[I]f you own your home and need to move for work or other reasons, selling your home is not the way to go.” You really shouldn’t ever sell or refinance a house with an interest rate of 3% or less.

“Instead, it makes more sense to rent out your current home and then rent where you are moving (assuming it doesn’t make sense or is unaffordable to buy there).”

It turns out that a lot of people took this advice or had a similar thought. At the same time that new listings are way down, we have noticed the number of rental listings shoot up in every submarket of the Kansas City metro area we have properties in, both for houses and apartments. It appears to be that way all around the country.

Furthermore, while rents on new listings were increasing by over 15% from one year to the next, that was nowhere near the rent increase the average tenant had to pay. As NPR pointed out, “Government consumer price data show that the average rent Americans actually pay—not just the change in price for new listings—rose 4.8% over the past year.”

The average increase on a lease renewal hasn’t come close to the average increase on a new rental listing. Thus, not surprisingly, many tenants (like homeowners) aren’t moving.

Americans, on the whole, are moving less than at any time since 1948, and according to data from RealPage, apartment lease renewals are at 65%, up almost 10% from just 2019.

With more properties coming to the rental market, that increases competition and puts downward pressure on prices. At the same time, most tenants aren’t paying rent at market rates for new listings six months ago because their lease renewals weren’t keeping up with market increases. Thereby, they don’t have much incentive to move if they are going to have to pay a substantially higher price in order to do so.

Several other trends have also contributed to this state of affairs. For one, many of the construction projects Covid delayed have finally come online, adding additional supply to the market. In addition, inflation and rising housing costs were nearing the limits of affordability in the middle of 2022. This has hampered rent growth, particularly by convincing more Americans to move in together.

As many as one-in-three adults rely on their parents for financial support, and many young adults, in particular, have taken to moving back in with their parents. More Americans are also open to renting out a room or portion of their house. A Realtor.com survey found that a full 51% of homeowners were willing to rent out extra space in their homes, a rate that is highest amongst Millennials (67%). Indeed, Americans living with roommates is an increasingly prevalent trend for years.

All of these trends put together are bringing rental prices back down to Earth.

Is Renting Your Property Now a Bad Idea?

As with the real estate market in general, it is highly unlikely that the rental market will collapse. After all, there is still a housing shortage, and new construction is slowing down again because of high rates (at least high by recent standards).

Furthermore, many people who were looking to buy a home are in the process of giving up and looking to rent. As their plans change, that will increase demand and put upward pressure on the market. And again, part of this recent decline is just seasonality, and as we enter the warmer months, the market should heat up again (pun possibly intended, I’m not quite sure), at least to a certain extent.

Rents skyrocketing over the past few years was an aberration, and the fact they are coming back down to Earth may not be great for landlords, but it is better for the country on the whole. While new purchases are made more difficult by higher interest rates, the rental market should stabilize.

You should not expect rents to be much higher next year than they are now. But I wouldn’t worry too much about being unable to rent your properties.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.