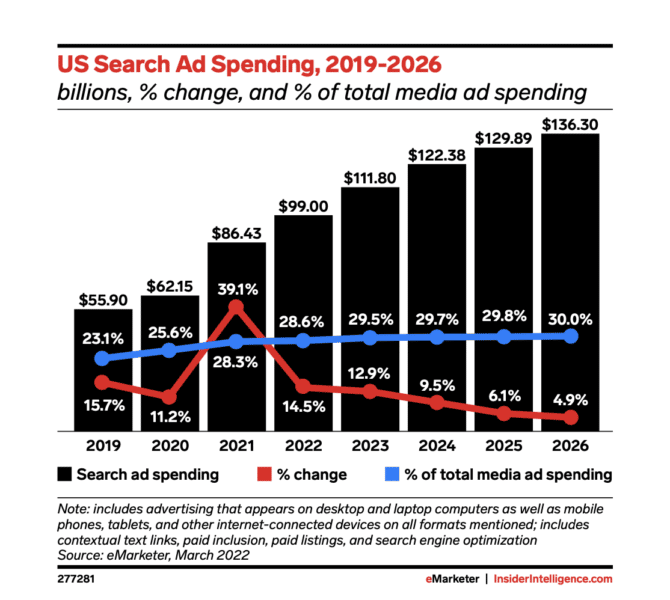

If you’re waiting for search ad spending to slow down any time soon, you’ll be waiting a while. A new report shows that CTV, linear TV, and video are the most vulnerable when it comes to cutting ad budgets.

In the US, Google dominates the search ad market, holding steady at about 56.1% of the total ad revenue share amongst platforms like Amazon, Microsoft, and Yelp. But even as the market shifts to other platforms, Google’s growth outpaces all other traditional formats. If we’re talking about general search, though, Microsoft holds the #2 position as Google’s top competitor.

Going beyond Google. Though Google leads the charge in search, other platforms like Apple and Amazon are slowly gaining speed. Apple Search Ads are growing to the tune of a predicted $5 Billion in revenue in 2022. New ad inventory is making room for additional developers and advertisers to advertisers to promote their apps and businesses in a less competitive, relatively underutilized space.

When a consumer is closer to making a purchase, they tend to go to Amazon, which seems to be the catalyst behind growth in overall search ad spending in 2022. Even TikTok is picking up momentum in the search game with reports that ecommerce brands had spent 60% more on TikTok ads in Q2.

TikTok may even be on its way to being a direct competitor for Google, with reports indicating that 40% of 18- to 24-year-olds in the US go to TikTok and Instagram over Google for their searches.

Get the daily newsletter search marketers rely on.

Managing various networks. Managing various retail media platforms is a real pain point for advertisers. For this reason, analysts predict that this is what could be keeping many of them from gaining market share. “If every single retailer has its own platform, learning to use and optimize would be a lot for the advertiser and that’s where the consolidation of a few big players would be a real competitor to Google as opposed to fragmenting in these small, small areas,” said Prerna Talreja, managing director of digital activation at independent agency Crossmedia.

We’ve compiled a list of 28 great PPC management tools for ecommerce brands. This is not an exhaustive list, by any means, but these tools can save time, improve efficiency, and help you manage multiple platforms with one central dashboard.

Mobile versus desktop trends. Search ad spending for mobile is exceeding search spend on desktop by about two-thirds. It should also be noted that more than half of the US population used a smartphone to search online in 2016. By next year, it’s predicted that that number will reach about 70%. Analysts predict that the gap will continue to widen over the next few years.

Privacy-first. Privacy-centric platforms like DuckDuckGo advocate for letting consumers take control of their information. However, the search engine may be losing steam according to a June report that revealed that its daily searches had dropped below 100 million.

For better or worse, many smaller search networks like Neeva and DuckDuckGo source their results directly from Microsoft.

Dig deeper. Download the entire report from Insider Intelligence and learn how big TikTok’s influence really is, why Google wants to draw attention to its competitors, the most vulnerable channels likely to see budget cuts amid brands’ budget cuts, and more. We should note that the report is paid, not free. But the value you gain far outweighs the cost.

Why we care. Advertisers working with search ads should be aware of industry trends, emerging platforms, and channel expansions. Additionally, knowing where the majority of ad spend is going helps you leverage, plan, and budget for changes and market volatility.

New on Search Engine Land