Many investors have watched short-term rental (STR) investing from the sidelines. They’ve heard the success stories and know there are high returns to be made, but often come back to some form of the following questions:

- Is it worth the risks?

- Is it worth the hassle to set up and operate an STR?

- How much more money would I actually make?

I’ve put together a simple decision-making grid using six categories to help you understand if short-term rentals are a good strategy for you and your investing goals. I’ll elaborate on each of these categories for you to understand whether or not you meet the criteria. If you and your property check the box on four or more categories, I would suggest that you strongly consider converting your long-term rental into an STR.

1. Laws and Regulations

To even get started on the short-term rental path, you need to check this box. If it’s illegal to operate your property as a short-term rental, I wouldn’t advise that you try!

If you are unsure if your property can be used as an STR, you will need to confirm the rules and regulations for your property’s municipality.

First, try checking your city or county website. Generally, you can find the short-term rental information on the planning and zoning page. If that’s a dead end, find a search bar and look up: “short-term rentals,” “Airbnb,” or “VRBO.” Some cities have whole pages dedicated to STRs. Others simply link to an ordinance that governs STRs, while many cities and counties still have no information posted.

If there isn’t any information, that doesn’t mean there aren’t regulations. Try giving the city zoning and planning department a phone call to ask if there are rules, and they can direct you to the right source.

If there are laws in the books, ensure your property meets the qualifications and that it would still be profitable after meeting said requirements. Many cities have adopted laws requiring an STR to be a primary residence, which rules out renting it as a pure investment property. Some municipalities limit the number of days you can rent out the property in the short term. For example, some cities only allow 30 days per year to rent out a short-term property.

Obviously, that’s not going to be profitable.

If there aren’t any regulations, it usually means you can operate a short-term rental, but just as a word of caution, that can change.

If an area sees an increase in STR operations, cities may adopt laws that can bring an end to profitable short-term rentals.

If your city allows you to operate your investment property as a short-term rental, you have checked the first box!

2. Risk Tolerance

Have you ever spoken with a financial advisor? At some point, they’ll ask, “on a scale of 1-10, what would you say your tolerance for risk is?”

What are you supposed to say? “Yeah, I love risk! The more risk, the better!”

But you don’t want to sound like a wimp either. You’re brave, right? You know that the potential for higher returns grows with riskier investments.

“I would say I’m a 4-6 in risk tolerance,” you respond.

“I think you would be a great fit for our moderately aggressive index fund.” Replies the advisor, emphasizing the word “aggressive” to stroke your ego a little bit.

I’m going on this goofy tangent to demonstrate that it’s hard to quantify risk tolerance. We know that there is risk in every investment, especially in real estate. We also know that investments with a greater upside generally have more risks associated with them. If you are considering your first STR investment, there is uncertainty simply because you’re new to it. When investors are considering short-term rentals, they mostly think about two primary risks:

- Potential damage to the property

- Financial instability

Damage Risks

This first point is hotly debated. Many investors (including myself) don’t assume increased risk in property damage for a short-term rental versus a long-term investment property. A long-term tenant can accidentally burn your house down just as easily as a short-term guest. In fact, you actually have more control over the guest’s stay in a short-term rental, and if they are causing problems, you have much more authority to deny access and less red tape than you would for a long-term eviction process.

Sure, there are horror stories. I’ve had several guests smoke in the house even though there are “no smoking” signs posted everywhere. People may get rowdy and have a damaging party. Guests will enjoy the hot tub a little too much. Appliances and dishes might break.

Yet, the same things can also occur in long-term rentals. When you first thought about real estate investing, you probably had multiple people tell you that tenants don’t take care of their homes or something of that nature.

While there are risks, STRs have several benefits to counteract those fears. You can put strict screening standards for potential guests, such as age minimums, valid IDs, and group limits. You can even restrict guests who have been reviewed poorly by other hosts from viewing your property at all. Additionally, your property will be cleaned regularly and inspected after each check-out to address potential problems.

Financial Risks

Of course, there are financial risks to also consider. Your short-term rental might not get enough bookings, and your occupancy rate is off-target. Your daily rate projection could just be off.

However, there is also the possibility that you could double, triple, or quadruple your returns by switching your long-term rental into a short-term rental. As with any long-term investment, you must have confidence that your numbers and projections make sense. Rely on your market knowledge or experts with experience in STRs, and take calculated risks that are highly likely to achieve your long-term goals.

Of course, if you already have a successful long-term rental, you know you can mitigate the risk further by returning to that model if your short-term rental venture doesn’t pan out.

Most of us who have found our way into real estate investing is willing to take on some temporary pain and risks to achieve our goals. As I’ve tried to demonstrate, there isn’t substantially more risk in STRs than any other real estate investment. Check the risk tolerance box if you’re willing to make the leap with a short-term rental!

3. Net Operating Income

In almost all cases, a rental will make more income per month if converted to a short-term model. That being said, income alone isn’t a helpful performance indicator because there are several additional expenses associated with a short-term rental compared to a traditional rental. The owner now pays all expenses that are usually passed on to a long-term tenant.

In your operating expenses, you must account for:

- Taxes

- Insurance

- Maintenance

- Supplies/inventory

- Power/electricity/gas

- Water

- Internet

- Landscaping

- Features unique to your property (pool/hot tub maintenance, pest control, security)

- Management fees (if you don’t plan to manage yourself)

In light of this, net operating income (NOI) is a much better performance indicator than income alone because it accounts for the property’s income after operating expenses.

Gross Monthly Income – Operating Expenses = Net Operating Income

If your property stands to make a considerable increase in NOI, you should strongly consider converting to an STR. If your property wouldn’t increase or if it’s a trivial increase, converting to an STR may not be worth the effort required.

I do analyses on long-term rental conversions for my short-term rental management business, and nearly every day, I see multiple properties here in the Denver metro area that would increase NOI by 50% to 100%. I’ve even seen over 200% increases!

BiggerPockets features a calculator with AirDNA that projects income and NOI. I strongly recommend taking a look at it.

There isn’t a magic percentage that determines if you should switch to STR. However, if you would make at least 20% more NOI with a short-term rental, you should explore the option more seriously.

As I mentioned earlier, I often see 50%-100% increases almost every time I run the numbers. If this is the case for you, I suggest you strongly consider STR conversion and increase your revenue!

Check the box on the decision grid if your property is positioned to increase NOI enough to pique your interest!

4. Cash Flow

Are you looking to make more cash flow from your rental investments? With rising interest rates and the rapid appreciation we have seen over the last few years, cash flow isn’t as easy to come by as it has been in the past. This trend even led BiggerPockets to produce a recent podcast episode entitled Cash Flow is Starting to Disappear: Is It Even Worth Chasing?

For those looking for financial freedom via real estate, cash flow is key to success.

Your current property might be breaking even. While this is a great long-term play with the projection of increased rents and appreciation, it’s not impacting your life today. Your property may only cash flow a minuscule amount, say, a couple hundred dollars a month, which covers maintenance costs for the year. Your property cash flows well, but you may want to change your lifestyle or increase your capital soon. If cash flow is one of your highest priorities, STRs need to be a tool in your belt.

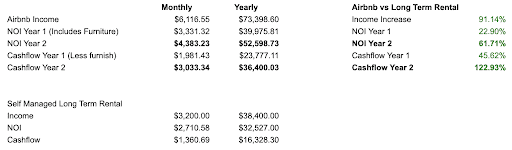

As I mentioned before, I run analyses frequently, and the properties that stand to make substantial gains in NOI also see significant cash flow increases. Below is an income projection I made for a four-bedroom, two-bath home just outside of Denver listed to rent at $3,200 per month as a long-term rental.

The property is positioned to make 122% more cash flow (after furniture is paid off) which equates to $1,673 more cash in the owner’s pocket every month. This projection also includes management fees in the operating expenses.

That is certainly nothing to scoff at! When you stand to gain $500, $1,000, or more monthly, that is serious money for those hoping real estate can dramatically change their life in the near future.

If switching to an STR significantly increases your cash flow, check the box on the decision grid!

5. Time

The following two categories, time and management, go hand in hand. Either one or both must be checked for an STR to be a good decision for you.

Do you have the time to set up and manage an STR? There will be a learning curve. You must furnish the property. You must learn the ins and outs of setting up and listing an STR on platforms like Airbnb or VRBO. Short-term renting is a hospitality service, so you must promptly and thoughtfully communicate with guests. The guest calendar and cleanings must be accounted for at all times.

There are many ways to automate your STR using channel managers such as Guesty, HostAway, Lodgify, cleaners, and calendar automation like TurnoverBNB, and to set up auto messaging within the platforms.

Managing an STR while working a full-time job is possible, but it isn’t always easy. Be honest with yourself and know if you are up for the challenge of taking on the extra work required to manage a short-term rental well.

If you have the time and are willing to take on the challenge, check the box on the decision grid!

6. Management

If you don’t think you have the time, that doesn’t rule out STRs for you! Like any other investment property, you have the option to hire a property manager. They are not simply collecting rent and solving tenant problems like a traditional property manager. Short-term rental managers do everything on your behalf, including:

- Set up, furnish, and onboard your property

- Manage online presence and pricing optimization

- Interact with inquiries and any guests relations

- Schedule cleaners, landscaping, and any maintenance needs

- Ensure supplies and inventory are fully stocked and accounted for

- Manage finances, including payments, invoices, and reports

Because short-term rental managers have more ongoing responsibilities than traditional property managers, they generally charge more. The industry standard for STR management is 15%-30% of your gross income. Run the numbers and make sure that a management fee wouldn’t compromise your financial goals.

Moreover, the availability of managers and vendors you know and trust is critical to the success of your STR. If you own a property in a market where you don’t have a lot of connections, be prepared for trial-and-error finding reliable cleaners, maintenance technicians, or managers. Networking and having the right team to manage on your behalf is a must before you launch an STR.

If you have access to good management and vendors, and your financial goals can still be met with management, check the box in your decision grid!

Make a Decision

How many boxes did you check?

Remember, the laws and regulations category must be checked. If it’s not legal, you should not convert to a short-term rental.

After that, either the time or management categories must be checked.

If you have checked four or more boxes, I would highly recommend that you consider converting your rental to an STR. If you have only three or fewer boxes checked, an STR might not be the right decision for you, and that’s okay. There are many ways to win in real estate, and short-term rentals are just one of them!

Find long-term wealth with short-term rentals

Vacation rentals can be an extremely lucrative way to boost your monthly income—but only if you acquire and manage your properties correctly. This ultimate guide to analyzing, buying, and managing vacation rental properties will set you up for immediate success and long-term wealth.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.