Zillow’s September market report has something much more interesting to say than what we already know.

What we already knew is that, yes, while mortgage rates are still elevated, even after the latest Fed cut, the year-over-year change is bringing back buyers and sellers across the country. What many of us didn’t anticipate is that, as identified by the data collected for the report, the top buyer’s markets are emerging predominantly in the South and Southeast, a huge reversal from the trends we’ve seen over the last four years.

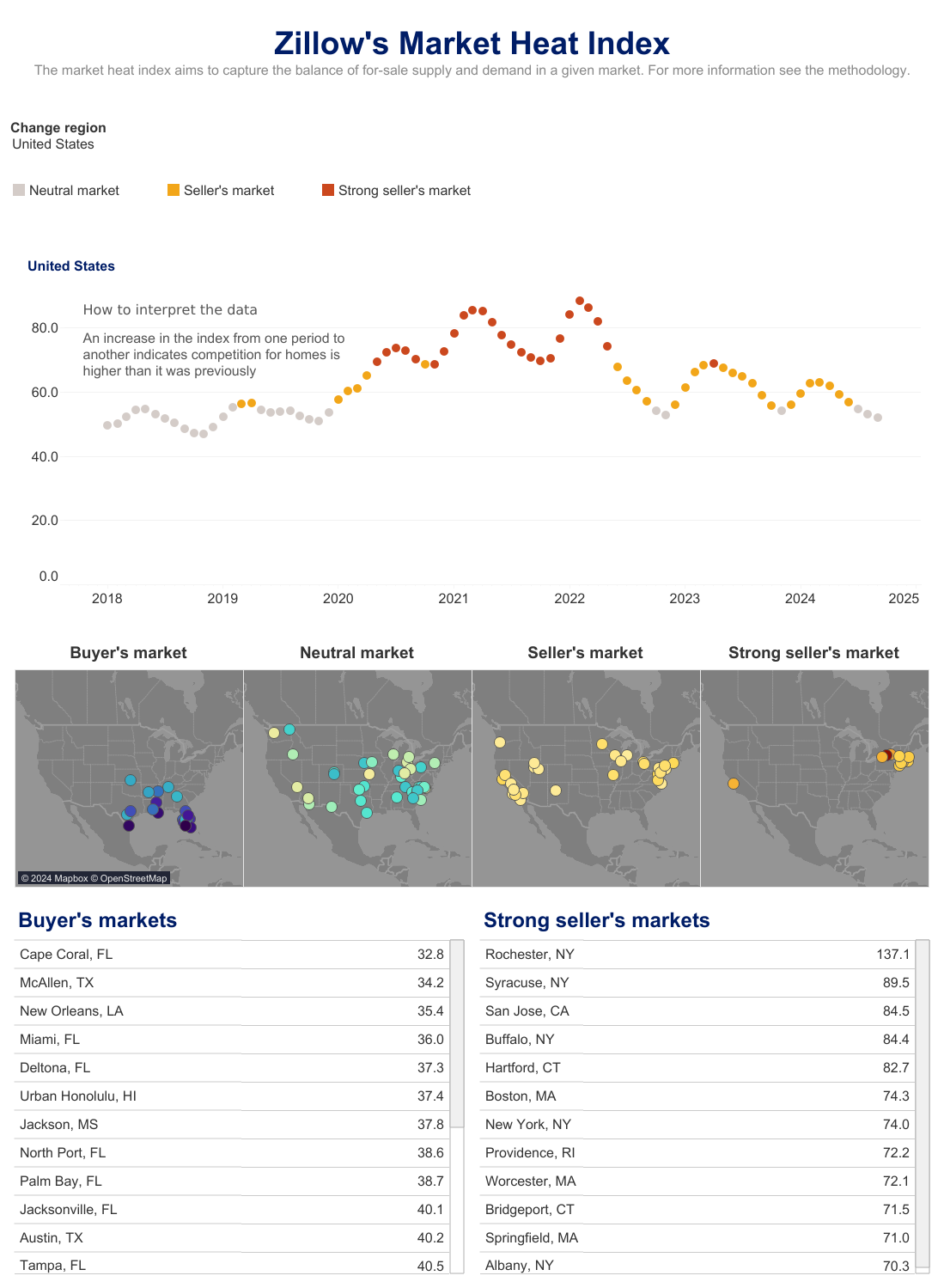

According to the report, “while the housing market nationwide remains neutral,” a number of metro areas in Florida, Georgia, Texas, Tennessee, and Louisiana are “tipping in favor of buyers.” The inclusion of Florida will surprise no one at this point: Enough has been said about its unique—and challenging—housing situation that is making life difficult for buyers and sellers in the Sunshine State.

But what about the other Southern and Southeastern areas? What is causing buyer’s market conditions in these metro areas? More importantly, can investors trust these conditions will last as a longer-term trend, or is this a blip in market dynamics that will quickly return to high competitiveness?

New Construction Is Paying Off

If you’ve been following along here, you know we’re not keen on attributing whole market shifts to a single cause. Usually, a more accurate way to explain what’s happening in any given market is that several factors are collectively tipping it one way or another.

So, although all the housing market reports point to recent interest rate drops as the reason why (some) housing markets are moving toward a more balanced state, this isn’t the only or even the main, reason why this is happening. Instead, what we’re seeing across several key metro areas in the South, including Austin and San Antonio, Texas; New Orleans; Nashville, Tennessee; and Atlanta, is a combination of a dramatic increase in home construction and a long-overdue attitude shift from sellers.

As far as home construction goes, it’s really paying off for rebalancing the market, and there is a clear correlation between more homes built and markets tipping in buyers’ favor. The most up-to-date new construction report from researchers at Construction Coverage identifies Austin-Round Rock-San Marcos, Texas, as the market building more new homes than any other county in the U.S. Nashville, San Antonio, and Atlanta are all in the top 15. And these are all currently buyer’s markets, according to Zillow’s latest market heat index.

Daniel Cabrera, owner and founder of Sell My House Fast SA TX, agrees that new construction has been a big factor in the shift in Southern markets: It “has created an increased supply of resale homes and is giving more negotiating power to buyers,” he told BiggerPockets.

New Orleans is the outlier here. The housing market in this metro continues to rely on the appeal of its historic charm. Not much new construction is going on here: Louisiana is No. 15 on the list of states with the lowest new construction rates, according to researchers at Construction Coverage.

New Orleans is not immune to the statewide home insurance crisis gripping Louisiana. The situation there is much more similar to Florida than to the cities in Texas or somewhere like Nashville.

Sellers’ Attitudes Are Shifting

You may have noticed that many of the buyer’s markets are now in areas that only three years ago were experiencing an unprecedented market boom. Austin’s dramatic rise is by now an apocryphal tale: It was one of the pandemic’s hottest housing markets. And it seems that, in Austin at least, home sellers were just unwilling to let go of that sense of the balance of power being firmly in their favor. As recently as July this year, Austin remained a neutral market despite months of growing inventory and slowing sales.

An article on KXAN described this state of affairs as sellers being mentally “stuck in a market that is ceasing to exist.” Austin Board of Realtors economist Dr. Clare Knapp said in the article, “That’s probably a by-product of what we saw during the pandemic when homes were really flying off the shelves. We’re still seeing remnants of that mentality amongst sellers.”

It took a few more months, but eventually sellers in the area did begin showing more flexibility, lowering price expectations. As of mid-September, Austin is one of the top metro areas where sellers are slashing their prices, according to Realtor.com. In fact, 25% of listings were showing reduced prices, which, of course, has an emboldening effect on buyers who are getting a clear signal that the market is cooling.

Other buyer’s markets are exhibiting similar patterns, with Realtor.com data showing 17.4% of homes sold with reduced prices in Nashville and 17.5% in Atlanta. By comparison, a strong seller’s market like Buffalo, New York, only had 10.8% of properties for sale with reduced prices.

Even with mortgage rates coming down, sellers in cities in the Northeast continue to benefit from inventory shortages. It’s unlikely that their mentality will shift in the same way as that of Southern sellers in the immediate future.

What Can Investors Expect?

If you are enticed by the prospect of casting your net into a Southern area that seems less competitive, you may be in luck, but you’ll still have to do your local research.

Brandi Simon, a real estate investor working in the Dallas-Fort Worth area, tells BiggerPockets that her current experience is that “buyers definitely have a bit more leverage now, but it’s still neighborhood-specific. Well-priced properties in good areas are still selling. It’s more of a leveling off than a full switch to a buyer’s market.”

In other words, areas that are premium and competitive likely will remain so for longer. Sure, it might be a bit easier to get a foot in the door in these markets. ‘‘I’m seeing fewer bidding wars,” says Simon. “For cash buyers like me, the opportunities are there—especially with distressed properties.” Homes in desirable areas will still sell, but investors may feel a little less heat in terms of asking prices.

That’s as of right now. The balance of supply and demand won’t stay the same for very long in these areas. The most likely scenario is that a new influx of buyers will re-create a competitive environment.

Robert Washington, an investor-focused broker in the Tampa/St. Petersburg area, tells BiggerPockets that the buyer’s market situation in the South “will be relatively short-lived,” because “as mortgage rates come down closer to 6%, we will start to see buyers that have been sitting on the sidelines coming back into the market.”

As far as Washington is concerned, the Sunbelt surge isn’t even over yet: “I feel like there is plenty of pent-up demand from people still planning to move to the South from areas like the Northeast and West Coast.”

Migration to the South is likely a long-term trend that has been temporarily dampened by overinflated home prices, high interest rates, and depletion of the available inventory by previous waves of said migration. If you can stay ahead of the next wave, you’ll reap the benefits of the buyer’s market scenario. Just don’t expect those conditions to be there for very long.

Final Thoughts

If you’ve been thinking about investing in the South, now is definitely the time to make a move. With new construction booming in Texas, Tennessee, and Georgia and more realistic seller attitudes in major metros in those states, you have a good chance of securing investment properties at a better price—before competition increases once again from a new wave of buyers.

Find the Hottest Deals of 2024!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.