Last week, I listened to On The Market episode “New Low-Interest Mortgages Are On the Way for Investors (How to Get One).” I was ready to learn the secret of acquiring a lower rate—and surprise, surprise—the three lending professionals had some ideas based on the market, but they had no crystal ball on what rates would actually do throughout the rest of 2023.

There were three quotes from the podcast that stuck out to me as a buyer’s agent and investor:

- Christian Bachelder, The One Brokerage: “Volume, just on a grand total, is down. But volume per investor, if that’s a metric that I could use, is definitely [up].”

- Bill Tessar from CIVIC: “I am really bullish on real estate, short and long-term. I think you can get a better deal today than you could six months ago. You can negotiate a little bit, you could demand a little bit more. You’re not paying over list price. You’re getting contingencies on your deals. You’re getting seller concessions on points. You’re getting all that stuff. That’s great. So I’m bullish on real estate.”

- LendingOne’s Matt Neisser: “The one thing I’d say to borrowers [that] I say to myself is I try not to bet on interest rates.”

My Takeaways

Smart investors are buying more properties in our current market. They are buying more because right now, there are good deals to be negotiated. They are not betting on interest rates but are bullish by betting on finding good deals on the initial purchase.

The rate can always be refinanced at some point down the road. You can only negotiate a lower purchase price, concessions, and repairs once.

I’ve seen this to be true in my own business, being able to negotiate hundreds or thousands of dollars in price reductions, concessions, and repairs for my clients in our current market. Your favorite BiggerPockets hosts also say they haven’t seen a better time to buy good deals in years.

I am always talking with buyers and investors, and the conversation I have had multiple times over the past few weeks has encouraged buyers not to wait for rates to go down before looking for a property. Right now, there is a buyer window that I don’t want myself or my buyers to miss.

In Denver, Colorado, we haven’t seen a buyer’s market or, arguably, a balanced market in the last 10 years. The past six months have been the first time in a long time that buyers can negotiate with sellers and get great deals. Yes, the interest rates don’t feel good, but you can negotiate a 2-1 buydown to help the monthly payment not hurt as bad the first two years, or you can wait for a refinance opportunity.

Here’s why you don’t want to miss the buyer window: Buyer demand is still present, and it’s not going anywhere.

Here’s my theory. As soon as rates go down to the low 5s or high 4s, all the buyers who didn’t purchase during the low interest rate period or who have a life circumstance that prompts them to buy another home will jump back into the market, especially in markets where there are good jobs and population growth. High or low interest rates, the demographics of our nation stay the same. Millennials, the largest living generation, are in their prime home buying years. Home buyer demand is present and won’t go anywhere anytime soon, especially in places where people want to live and have good jobs.

Along with traditional buyers, many wall street-backed investment funds pressed pause after interest rates increased. When rates go back down, you can bet that these funds that already have partnerships and infrastructure established will be well-positioned to jump back into the market if there’s money to be made.

High mortgage rates have pumped the brakes on demand for a bit. Although inventory has increased across the board, if buyer demand increases, it could easily be wiped out, and another aggressive seller’s market could be created. If and when that happens, we will say goodbye to negotiating prices and concessions on most homes.

Real estate is cyclical. Outside of artificially low interest rates from 2020 to early 2022, causing demand to be on the rev limiter essentially year round, there is normally a regular cyclical pattern to buyer demand. People have New Year’s resolutions and a shot of energy with a new year. We almost always see an uptick in activity in January after the holidays. We see that play out now, as highlighted by increased mortgage applications in January. Like people going to the gym, demand tapers off as people get settled into the new year routines. In April, the weather gets nicer, and people start planning for summer and what they will do when their kids are out of school. We see the highest buyer demand through the spring and summer, and it tapers off into the fall/winter as people come back from vacations and kids go back to school, and the cycle repeats.

There is almost always a small buyer window in the winter for people to find better deals because there’s less demand. That window is better this year because our high interest rate environment has led to even less demand leading to more inventory, more days on market, and, therefore, an increased ability for buyers to negotiate prices and concessions.

Final Thoughts

Once demand goes up in the spring with the regular real estate cycle, deals will be harder to find. If that is compounded with lower interest rates, negotiating prices and terms will be even more difficult. We know there is a buyer window right now, and we don’t know when it will end, so I’m encouraging buyers not to wait but to act. We can’t predict the future, but we know good deals can be found in our current market.

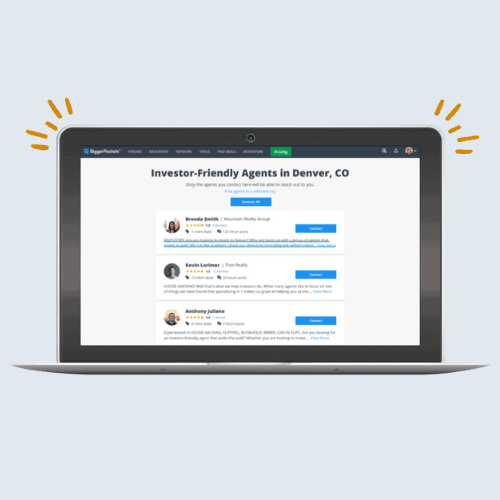

Find an Agent in Minutes

Match with an investor-friendly real estate agent who can help you find, analyze, and close your next deal.

- Streamline your search.

- Tap into a trusted network.

- Leverage market and strategy expertise.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.